Firstly a note on the photo above and no it’s not another drawn out piece on Amazon. It’s the vegan section of a Houston supermarket following the recent floods. When given the choice between starvation and eating vegan Texans appear to be choosing the former.

Humans are curious animals. Texans are no exception.

Now on with the show and again it’s “no nukes is good nukes” for the market. The threat of nuclear war is barely enough to move the market seismograph and we continue to be bullish in the absence of disaster. So much so I’m introducing the “VFS Group Early Warning & Market Assistance System” and the warning levels look like this:

- Nothing happens– buying opportunity

- Trump Tweets– buying opportunity

- North Korean nuclear testing– buying opportunity on dips

- Actual nuclear war– why are you watching the markets? Go home. Adjust your solar panels and make sure your generator is topped up.

Please use this as a guide over the coming weeks. Note when we say “buying opportunity” we’re mostly referring to places other than Australia. Locally it’s still sideways and cautious. Trade the edges.

If there has been one recurring theme from August reporting season it has been in the size of disappointments. That is to say that the disappointments have been at the bigger end of the market. In my experience the two hardest stocks for people to part with are CBA & Telstra and they’ve absolutely been the two best shorts on the market. We’ve been let down by the big end of town but always a good time to remember not to be too attached to companies in your portfolio.

As I say, roosters and feather dusters.

Definite rooster BHP at the moment. Courtesy Bloomberg

Funnily enough it was the ‘Big Australian’ of BHP that provided one of the few shining lights in a dark, sideways market. Leaving Iron Ore aside there was a few conversations about the rally in metals prices. The S&P GSCI Industrial Metals spot index has rallied ~22% this year after a ~19% rise in 2016.

A little time for a refresher course in metals pricing was provided by one of my favourites Jodi Gunzberg, Head of Commodities at S&P Dow Jones. She was quoted in Barrons this week and put it best here:

“”Industrial metals are one of the most “economically sensitive sectors,” and they’re priced in the greenback, so they move “oppositely from the falling dollar,” says Jodie Gunzberg…estimating that the currency’s decline of more than 9% year to date accounts for most of this year’s gains for industrial metals.”

Source: http://www.barrons.com/articles/industrial-metals-rally-grows-selective-1504324266

There’s always more to it but put simply Trump’s inability to get it together has caused the USD to decline and that’s a big reason why metals have rallied. Funny how the world works, isn’t it?

S&P GSCI Industrial Metals Index Courtesy Bloomberg

Beware. And Beware. And Beware

Sometimes (often) you get to see a bubble forming right in front of your face. We saw the tech bubble, we saw US housing, right now we’re seeing Bitcoin, which has grandmothers everywhere wanting a piece of the action. Initial Coin Offerings (ICO’s for short) are springing up everywhere and each one more ludicrous than the last.

Bitcoin started the Crypto-coin phenomenon and there are many others that work in a similar fashion like Ethereum & Ripple to name a few ‘alt-coins’. Now every man and his dog has a new “coin” and they’re raising money for it.

Imagine the Tulip Mania of the 17th Century but people coming up with different types of tulips and asking you to put money into their tulip farm. These guys don’t have tulips, or even gardens, but people are plowing their hard-earned into these ICOs “because everything’s going up.”

The very extraordinary Jonathan Tepper (who helped spook our housing market last year) posted this last week which compares various bubbles over years of maturity, coming off a common base and in terms of percentage gained. I present it as Exhibit A:

1200% in 3 years. This is probably fine…

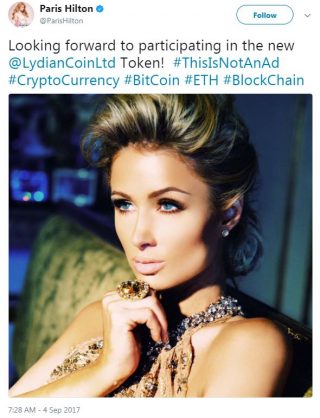

Remember just because it’s a bubble doesn’t mean it’s going to burst (again think Aussie housing) but the real way to tell it’s a bubble is when this sort of thing starts to happen.

Observe Exhibit B:

“This is not an ad”??!!

Funnily enough the same day Paris’ bombshell hit the wires was the same day China ruled ICOs were illegal. (Last night, September 4th)

They crypto community is calling last night “Massacre Monday” so finally Exhibit C:

Courtesy @Bitcomg

Beware the bubbles.

Stay safe & all the best,

James Whelan & the VFS Investment Committee

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au

Additional: Our own Head of Financial Advisory Danilo Medojevic has been shortlisted for the finals of the SMSF Adviser Summit Awards in the field of SMSF Investment Strategy. We wish him all the best to get the gong.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.