Register now for the launch of our newest product: The VFS Global Macro Fund. August 2, 7.10pm

It’s a frustrating thing when writing occasionally funny yet always insightful market commentary that something you’ve been putting together for a week on the unwinding of bond proxies suddenly becomes temporarily moot.

That very thing happened this week and as usual it came from the Fed. The other candidate for “spanner in the works” is usually a British referendum or election but this time it was Janet Yellen.

So I’ll amend a few things I was going to write as a warning for later with an eye on how good things are right now from an investment perspective.

For a start the one thing that really caught my attention early in the week was a Goldman Sachs Strategy piece on the direction change for the Australian Market.

Some background: The Goldman’s team have run a ‘Low Vol’ strategy for the last two decades where they buy stocks in the ASX 200 that have lowest historical volatility and sell those with the highest. There’s more details behind this but that’s the basis of it and it’s performed an admirable 15% p.a. since 1996. This sentence should make you sit up, though, “With most of the tailwinds that have supported this theory now fading or in some cases outright reversing, we are increasingly cautious on the outlook for this strategy.”

Important to note, then, that the stocks that have done the best for them (and many others) are now on their sell list due to being low vol, having a dividend yield over 20% below their decade average and carrying high levels of leverage. You’d recognise the names, there’s a few commercial & office property stocks, a few infrastructure stocks, a few health care stocks and an airport operator whose name I can’t tell you for compliance purposes but I can tell you rhymes with Dydney Careports.

Hint: It’s in Sydney

Learn how we select our macro themes: Global Macro Fund’s Launch Webinar. Register Today!

The reason underlying all this directional change is the obvious one: interest rate risk, which they see as being the key systematic risk in the local market.

This takes us to a familiar story last year which began to rear its ugly head again recently, that being the sale of “bond proxies.”

To rehash the old reasoning from long ago, the investment community has had to look for the next best thing to invest in since the bond market hasn’t been returning enough to make it worthwhile. These stocks are the safest things you can find in equities markets: airports, toll-roads, infrastructure stocks. Easy to predict, decent yield, minimised risk. Low rates mean high levels of debt is OK.

Now that trade unwound last year as the threat of rising interest rates returned to the fore and we had the first warning shot on some of those much-loved bond proxies. Then it seemed like that fear stalled this year and there was a rally once again in the safer end of town. Once again over the last few weeks we’ve seen this unwinding take place again as the US was expected to be talking up interest rate rises.

I was keen to commit to this trade as well but thought we should just see what Fed Chair Janet Yellen would say in this space at her Wednesday & Thursday night testimony. Annoyingly and frustratingly it was a dovish tone from the Fed Chair, followed on Friday night by ordinary US CPI so it’s safe to assume the unwinding of the bond proxy trade is postponed…again…

I wanted to say the unwinding is being unwound but that sounds ridiculous.

You’ve been warned again but for us is the real challenge of balancing between the weight of money into safe certain spaces on one side and very smart Goldman Sachs strategy research on the other.

I will resign to the safest of market commentators spaces with the term carrying the highest ratio of usage to usefulness and every time I hear it uttered I cringe:

“It’s a stockpicker’s market. Investors should be selective with their holdings.”

Ugh…When is it not?

Actually now I think of it there’s a relatively easy trade in the US right now (but still, know the stocks you own) that can just be done around any data releases or Fed speak:

If data or chat is inflationary, buy US banks.

If data or chat is not inflationary, buy US tech.

So maybe investors would be better off being ultra-picky on their holdings locally, but far more bullish on their overseas holdings.

Note that the other big thing ahead for the Fed is the unwinding of their colossal balance sheet from USD 4.5tn to (according to median surveys) about USD 3.2tn. I urge caution regarding being to complacent with this and take comfort that smart guys like JP Morgan’s Jamie Dimon are also urging caution:

“…it could be a little more disruptive than people think…We act like we know exactly how it’s going to happen and we don’t.”

Beware regarding all of the above and its impact locally and we reiterate our warning again:

Australian debt & mortgage levels are at record highs with wage growth floundering.

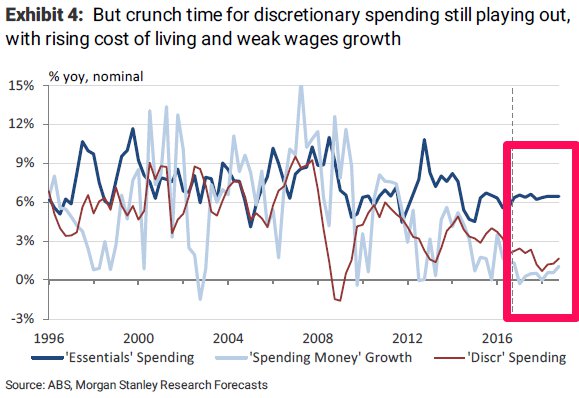

Don’t even start me on energy prices which we’re still yet to see impacting consumer spending numbers but if the below chart is anything to go by I’d be very afraid as an Aussie with high debt or as a company depending on Aussies to spend money with me.

Any increase in rates in the US will flow to Australia either in the form of increased variable rates or in banks having to absorb that margin squeeze themselves. Either local borrowers or investors in banks will get hurt by this. In all probability it will be both.

In summary, the postponement of rising rates may mean that the Goldilocks scenario of funny money being bullish for markets continues, however at some stage the music of cheap money needs to stop. Just make sure you’re near a chair when it does. Also note that just because this is the case in the US, it is absolutely a different story locally.

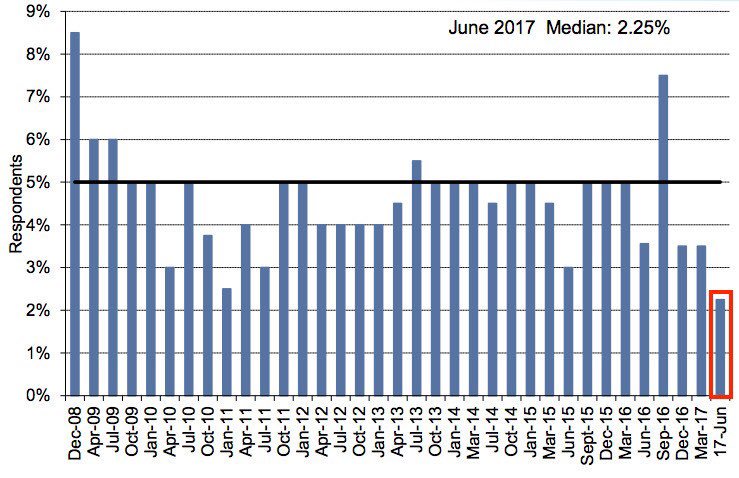

Institutional cash holdings as per survey compiled by Citi. When the big dip does come there’s not a great deal of cash on the sidelines to buy it.

Again courtesy Business Insider with the link here

All the best,

James Whelan & the Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

+1300 220 360 | gmf@vfsgroup.com.au | www.vfsgroup.com.au

Register now for the launch of our newest product

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.