Unsurprising to most, a large part of my upbringing was spent watching British TV comedies. As much as this helped shape (warp) my sense of humour it also has helped me understand the British regard toward Europe as a whole.

From Basil Fawlty not mentioning “the war” to almost every Blackadder to the entire series of ‘Allo ‘Allo, the Brits have had a comedic yet subtly difficult relationship with the Continentals.

A sketch-show I used to love in the early 90s called KYTV used to run a parody of a news desk and an episode has kept reappearing in my idle thoughts so much I had to dig it up and watch it again. The episode was done around the time when the English-France Channel Tunnel was due to be opened and ran some good scythe on England’s view towards being a bigger part of the continent.

One line from the stereotypical English pundit included would surely be found in the UKIP manifesto 25 years later:

“I’m all for European Unity….so long as we aren’t included in it.”

Nigel Farage before there was Nigel Farage…

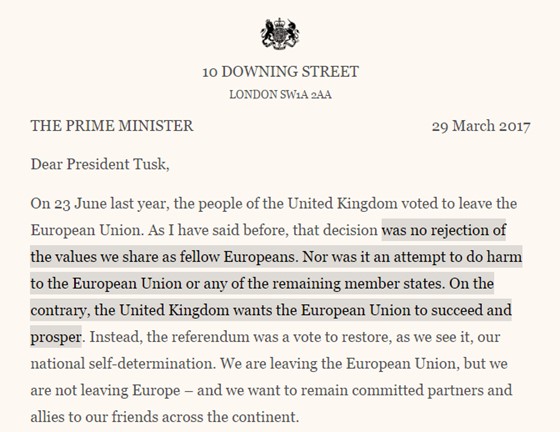

Comedy has a great way of pointing out the truth people blind themselves to and this truth resonates in the language of the Article 50 triggering letter from PM Theresa May to the European Council last week.

Courtesy The Pain Report

A fancier way of saying “we fully support the Union and everything it stands for. However we don’t want to be a part of it and for that matter nor do we agree with everything it stands for…”

Speaking of standing, we stand by our “Long Pound” call from January and are still adding to Australian equities with GBP exposure.

We still see the fallout from Brexit as being overblown and have seen much evidence statistically and anecdotally to show us that smart money is buying British. I can’t post it here but we have many contacts who are making all the right moves in the old country.

Call me for details.

These guys get it….

Crossing over to our Hedge Fund PM & close friend David Pain to add something with more weight (and less comedy) to the argument…

“Recent economic indicators across Europe have turned broadly positive. Inflation is ticking up as are employment indicators and PMI’s, a key leading indicator of economic performance.

On top of this, Europe trades on a much cheaper level than the US, having faced severe questions regarding its political stability. With the election of Mark Rutte in the Netherlands and a very poor showing by the far-right candidate Geert Wilders, a consensus is emerging that Europe is once more “investable.” This is a trend I have seen occur many times.

The US rallies whilst Europe lags until a catalyst emerges that make Europe investable again.

As such we initiated a long position in France two weeks ago. In the early French presidential debates the centrist candidate Emmanuel Macron performed extremely well and won every single post debate opinion poll. Marine le Pen (the far-right candidate) had a disappointing night first-up & again recently. Thus, it is our expectation that French equities will rally as the political risk premium currently priced in is removed.”

When it comes to Global Macro themes, I’m the Baldrick in the James & David relationship…

Anyone looking to gain the benefit of David’s insight instantly instead of two weeks after the fact please call me.

Finally, I’m contractually obliged to put something about Amazon in every note I write.

This graphic speaks for itself re what to expect in Australia. We’re buying France & GBP & selling everything Amazon dominates.

That is all.

The Amazon Graveyard in the States….

All the best,

James Whelan,

Investment Manager

VFS Group Investment Committee

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.