The art of good commentary is to be able to make grand statements sound conclusive whilst leaving plenty of wiggle room. Fan favourites include “markets were mixed today,” “this stock will almost certainly keep going up until it commences its pullback. Note this pullback may have already begun” and “it’s a stock picker’s market. You have to be savvy and switched on. The next week will be crucial…”

So I’ll shoot for the moon here and declare that there has finally come a time in my life when I can say with some certainty that we may be at the bottom of the rates cycle.

I’ve said before (as many have) that there’s only so many bullets in the respective guns of Central Banks. They took it on themselves to solve the post-GFC liquidity crisis and since then have turned themselves into both the solution and the problem containing global markets.

Have they conceded their day is done? Possibly. It does appear that the latest round of chatter from the world’s central bankers has a definite tone to it. The next week will be, as always, crucial…

But first, the news…

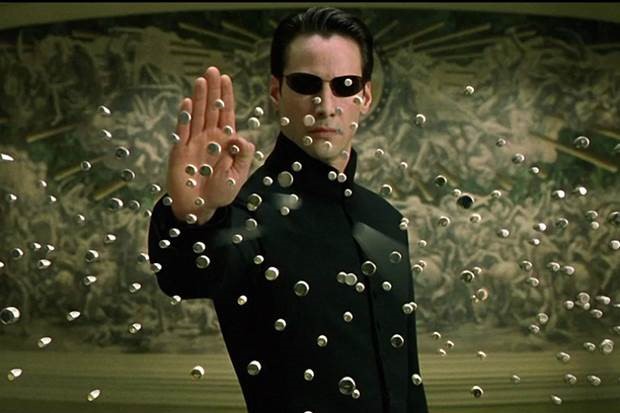

According to a Bank of America Merrill Lynch note to clients, using comments from notable scientists and inventors, there is a 20-50% chance we are already living in a virtual world (yes, like the Matrix). It is possible, they say, that future civilisations could have used their technology to create a simulation of their ancestors. Please do read the link here because it’s actually quite a well thought out piece.

If it is the case then there is a 50/50 chance that this didn’t actually happen yesterday:

A rough day for all concerned…

Regarding Rates….

All eyes are now very much on what the Fed is going to do with their rates and there are various scenarios attached to every word uttered by various Fed members. If you twitch at every move then you’ll do nothing but chase your tail into the poorhouse.

If you stand back you have a chance to look at the whole chess board and make some decisions.

- The Fed continues on the path of last Friday and talks about raising rates regardless of how perfect the economic data is. This will send the USD further up. Any weakness in the AUD is a positive to certain sectors here, particularly if China still continues to be China. Look to hospitality and tourism. Australian inbound tourism for July ’16 was released recently and showed some very good numbers. Total inbound for the year was up 10% with Chinese inbounds up 23% year on year. These are seriously good figures and I see no reason to get in the way of them.

- If our dollar declines, that’s “job done” for the RBA since that was the only thing they were really worried about. Tourism is good and our exporters are happy. We will be at the bottom of the rates cycle.

- Banks, theoretically, should do well. Rising rates means rising margins. Rising margins are good for shareholders. However there’s always this to remember from September 4th:

a. “Half NSW mortgagees are concerned about making their repayments.Last week’s retail sales showed a big dip in NSW and Victoria dragged the overall national sales growth to 0% in July. That’s not entirely surprising when viewed in the context of a Domain survey released over the weekend. Domain reported that “despite interest rates being at record lows, half of NSW mortgage holders are worried about not being able to afford their home loan repayments, new data shows”. With record levels of household debt in Australia being led with big increases in Sydney property prices, the data showed “of those surveyed, one in five were worried they’d never pay off their mortgage entirely, and 20 per cent were concerned about rising rates”.” Courtesy Business Insider with Domain link here.

- So the banks might not have a great time of it. Whilst rising rates are good for margins, this will be cancelled out by the rise in defaults. As usual I’m sure they’ll figure something out. However it’s a good time to have a look at those debt collection stocks I like around this time of the cycle.

- Home builders and their derivative suppliers will not travel so well. We already have a glut of apartments in Australia and an upwards trending rate cycle will mean the squeeze will be on for them. You can already see this reflected in the share prices of Boral, Mirvac and Stockland as sizable institutions find the exits.

- Beware those stocks you are in purely for yield. I’ve liked them for a while but now the paradigm has shifted and we have to admit rates are at a bottom. The key reason these were a good play was because rates were near zero (or negative). Now this is not going to be the case so these are being marked for the exit. Think Telcos and Utilities and tread with caution.

- Debt: Beware companies with too much debt. In a rising rates environment these companies feel the pinch more than any. As part of your usual screening of a stock now is the time to ask about debt levels.

- One from the hedge fund space courtesy of our good friend David Pain. “I actually think the REITs sector could get particularly hurt as a rising rates scenario is particularly negative for them. The utilities still have legitimate businesses regardless of where rates are (they just become less attractive on a relative basis). REITs however have very real default risk. Australia more broadly will be hurt. There has been a lot of buying of Australian equities due to its high yield like qualities. This will reverse from the international community in particular.”

So there you have it. Some things to look out for IF the Fed charge ahead with a rate rising plan into 2017. Already this hawkish view has been talked down and every night will bring news of off the cuff remarks by various FOMC members.

But, with a 20-50% chance that none of this exists anyway, the next week will be crucial.

All the best,

James,

Additional: Follow up to The War on Banks

On the 27th July this year VFS put out a special report with the eye-catching title The War on Banks. A link to it can be found here. It called out the Big 4 Australian Banks and the numerous risks they were (and still are) facing. A link to it can be found here:

Since publishing this, the Australian banking index has performed poorly:

We included some points on CBA trading at a high Price to Book ratio of above 2x and that this would be more appropriate at 1.5x. We forecast this would come down due to the detriment to profitability the Bank would feel in a low interest rate environment.

This is what CBA has done since:

With a P/B Ratio that has receded to levels not seen since 2012.

Making these calls in July was far from the bravest thing done in stockbroking. All we did is put ourselves in the mindset of the weight of money that were shorting the banks and broke their reasoning down into simple logic.

Do we have more ideas like this? Absolutely.

Stay tuned for what’s next.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.