Last week a colleague and I took a tour of regional NSW (Orange specifically) to discuss portfolio strategies and China. VFS Head of Strategy and resident China expert Jack Kouzi gave a great talk on Chinese growth being more substantial than just GDP growth and iron ore exports, that their ambitions in other fields are a good indication of their overall intentions. One of the points Jack made was that China wants to put a man on the moon by 2025. That’s all good and well for them but it was on the long drive home that my brain started turning this over.

“Wait, Jack, China wants to get to the moon by 2025?”

“That’s what they said.”

“So it’s 2016 and China think they’re 9 years away. In ’63 Kennedy made the pledge to get to the moon and back by the end of the decade and they did. In your phone you have more combined tech than the whole Apollo Moon Mission.”

“So?”

“So I think there’s no way they went to the moon in 1969 using duct tape and goodwill while one of the most technologically advanced countries on the planet, almost five decades later, thinks they’re years off….”

We did a little Googling and found plenty of fun websites that helped with the rest of the drive and as much as I’d like to dedicate an entire piece to these theories there is an ulterior motive for bringing the subject up. Read on….

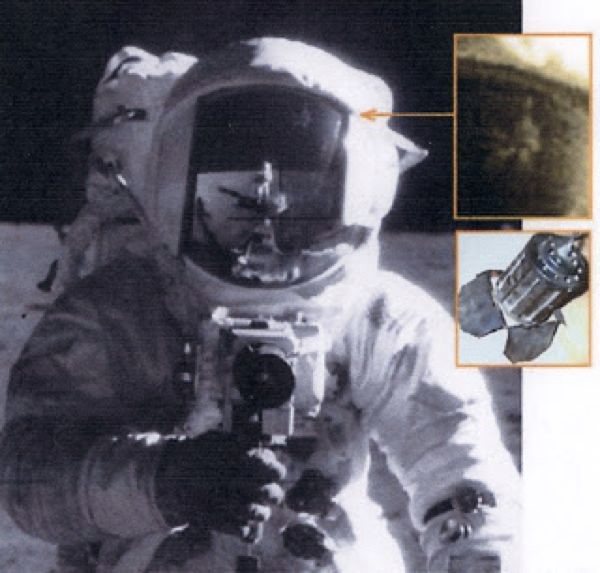

However, why are there no stars in this photo?

We’re not good at “things” anymore…

Due to the changed circumstances in our household, my wife and I have recently done our shopping online via Woolworths. Having unsuccessfully tried this once many years ago I thought it was likely Woolies had ironed out all the wrinkles in its systems and could provide the service they claim to be able to provide. The result? Three consecutive weeks of disappointment.

Twice some products have been absent and once food was added to the delivery. That was bizarre since not only was food added to the delivery but was also added to the checklist attached to the delivery. At some stage, someone added a 1kg roast beef to the order sometime after we’d hit ‘submit.’ It blew me away that a system could possibly allow that flaw to even exist. What really made me take pause was just how fast and effective the Woolworths Customer Complaints team was.

Between sending an email noting missing products to receiving compensation in our bank account was less than an hour. That troubles me a great deal because it means the volume and regularity of complaints must have been so high that they built a state of the art reconciliation system. They don’t even ask for details anymore, they just send the money instantly. There’s one other major company I can think of with a readily available, state of the art complaints handling team and that’s Telstra. I spent a good deal of time on the phone to iiNet last night after our internet was out again (iiNet runs off the back of Telstra) so I’m all too familiar with their call centre.

There’s companies I’m sure Woolies wants to be compared to and I’ll guarantee you none of them are Telstra.

Dude, where’s my market?

The ASX, not for the first time in recent memory, pulled a colossal clanger and botched the market which, as you can see from the above, was only open for a small portion of the day.

Woolies are batting 0/3 so far but I’m going to stick with them for no other reason than I’m a glutton for punishment and we have no other choice.

Telstra has a worse average but I’ll stick with them because it’s Telstra.

As for the ASX…well where are you going to go?

This country has a series of fatal flaws which have been born out of multi-generational monopolies.

There is an arrogance and an attitude that cannot be allowed to continue.

We live in an age where so many incredible things are possible yet we continue to strive for, and accept, perennial mediocrity.

Yet…

Keep your eye out for Amazon Fresh. Around July there was some news on them targeting a 2017 Australian launch and it can’t come sooner. Amazon is one of my preferred US stocks and credit to our Hedge Fund correspondent David Pain for opening my eyes to the reasons why. Do your own homework on Amazon but I won’t be anywhere near the supermarket stocks when this news drops.

What a difference a week makes!

Putting that week behind me is a must with all panic on Monday morning turning into Business as usual by Friday. Bad news is currently good news and, thinking about it, good news is good news too. The market has clearly spoken that there must be strong and continued economic growth before the long slow rate rise climb in the US can commence.

As I mentioned last week “If you twitch at every move then you’ll do nothing but chase your tail into the poorhouse.” I still stand by this statement and I think that the shift in sector sentiment will be a long, slow one. However a warning was given last week that you need to be making arrangements now to prepare for the bottom of the rate cycle to be upon us.

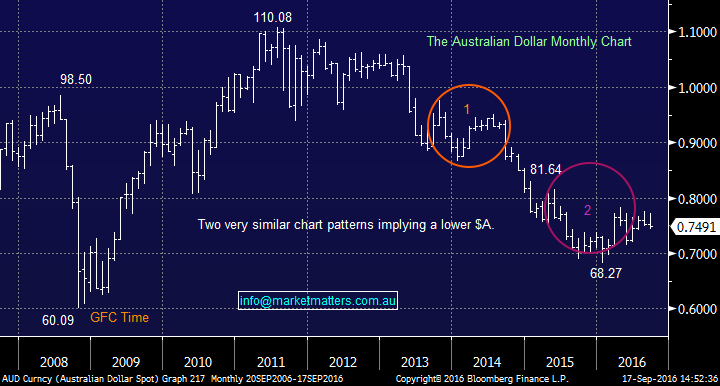

We had a good read of the Market Matters weekend email and I encourage all to subscribe and hear what they have to say. One thing they stressed was that the Aussie dollar index looks set to correct back down to 60-65c from its current level of the high 74c mark. They also note that strength in the US Dollar means commodities get beaten up. I’m inclined to agree. Here are the key comments:

we think the $A is close to rolling over with a target of the 60-65c area.

If the $US rallies 6-8% a pull back in commodities and related stocks is likely.

Here’s the plan as it stands, again IF we’re at the bottom of the rates cycle in the US:

- Fed raises rates either with or without the stars aligning for economic growth- they’re at the bottom of their cycle

- USD rises, AUD falls

- AUD falls- the only reason for the RBA to cut is now removed. We’re at the bottom of our cycle

- Sentiment continues to shift out of the “bond proxies” (utilities, telcos)

- Aussie stocks reporting in USD do well

- Stocks benefiting from rising yields do well

- Stocks that have too much debt or have used cheap money for buy backs will do badly

- Banks everywhere should do well. Aussie banks are still leveraged to a really dubious residential market so I’d still be a little hesitant

- China is apparently borderline basket-case with their credit to GDP gap is now at a dangerously high 30.1 – read this and panic

- Australia (despite the above on China) should get bought well once our dollar comes off by foreign funds capitalising on the relative cheapness this would bring

With that in mind answer me this:

If there is no atmosphere on the moon, why is the flag in this photo waving?

Maybe it won’t be until we can get online grocery delivery right that maybe we may truly explore space….

Something to think about and all the best,

James