We thought it prudent to send a note this weekend since the Trump/North Korea situation appears to have moved off Twitter and into the real world. We can’t and won’t predict what exactly will happen in Korea but there are ways to profit & protect capital from the escalation of tensions.

Breaking it down to a simple buy/sell/hold decision I will quote myself on Twitter from late Thursday night when I said,

“For the record we fully intend on buying key stocks in this market unless we are wiped off the face off the earth. Then we may reconsider.”

Jokes aside it’s a market to trade, not exactly a market to sell and (at least for now) probably not a market to buy. There’s no shame in cash and buying “the market” is not a great idea right now. However, there are ways to be invested while gaining benefits of currency moves in times of crisis.

Here’s something we put together this week on how we use currencies to our advantage which we hope you’ll appreciate.

This week’s move in CHF/AUD highlights some of the more interesting ways in which we are managing to hedge our portfolio against unexpected events.

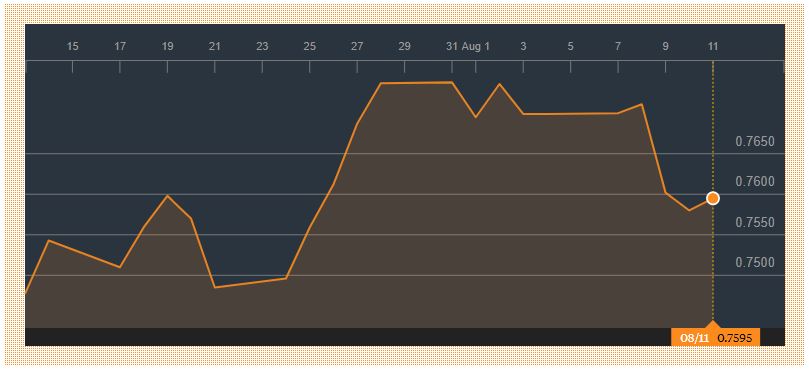

AUDCHF showing the drop from .7711 to .7580 this week

Courtesy Bloomberg.

Replay of our Global Macro Fund’s August Webinar

Over the past few weeks one of the currency crosses that we have been looking at with great interest is the Swiss Franc (CHF) against the Australian dollar (AUD). This is commonly expressed in forex terms as AUDCHF. For those unfamiliar with the forex terminology, when you buy or sell a currency cross you are buying or selling the first currency in the pair. So a “buy of AUDCHF” is a buy of Aussie Dollars & a sell of Swiss Francs.

Speaking frankly…

This probably seems like an unusual cross to many people as it isn’t obvious that there would be a lot of correlations. However, these two currencies play a critical part in what is known globally as the ‘carry trade’. The carry trade is a trade whereby an institution with sufficient leverage (usually a hedge fund or other asset management group) borrows in one currency and invests in another (i.e. buys bonds in another country’s currency). For a very long time CHF (Swiss Franc) has been a significant funding currency for hedge funds. This is due to Switzerland’s very low interest rates. Effectively an institution can borrow in CHF at say 0.5% and buy bonds in another, higher yielding country’s currency. (Japanese Yen is another currency very popular to use as the funding currency for the carry trade).

The AUD has for a long time been a favoured choice for the carry trade. A relatively stable democracy (note: “relatively”) with a decent growth rate and higher than average inflation means Australia typically holds higher interest rates than other more mature and slower growing economies. By borrowing in CHF and buying AUD bonds a participant can generate a ‘spread’ between the cost at which they borrow vs what the AUD bonds yield. This ‘spread’ (or carry) is then levered up substantially, (say ~20x) and if you have a spread of 1.5% (which is quite common) then all of a sudden, with all things going right, you can have a position generating 30% yield annually.

Frank would have liked that

If you were really greedy and happy to take on even more risk you could even buy corporate bonds in the higher yielding countries currency thus juicing your spread even more. Many institutions make a lot of money doing this every day.

By the way, all this serves to drive the funding currency lower (in this case CHF) and drive the higher yielding currency higher (in this case the AUD). A large part of the recent rally in the AUD has been driven by the carry trade.

So what does this have to do with a Global Macro Fund (which does not participate in this trade) and what relevance does it have to our clients’ portfolios?

Good question, thanks for asking.

Simply put, the carry trade reverses in periods of extreme stress. For example when the US President decides to tweet something about North Korea with an aggressive tone markets go ‘risk off,’ thus selling off what assets they own. In the case of the carry traders this means selling off their higher yielding currencies, all of which leads to a very sharp move (such as what we saw on Wednesday night in the CHF/AUD) in a very quick amount of time.

Thus by taking a long CHF position against the AUD we can generate a very effective hedge for our clients at a very low cost (remember that during good times everyone is happy to take the other side thus making the trade cheap). And when Donald decides he wants to sabre rattle we look very good having provided an effective portfolio hedge for our clients.

This is also an excellent example of the kind of dynamic hedging we are looking to employ for the Fund. To find out more please drop us a note & we’ll do our best to assist.

All the best,

James Whelan & the Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

+1300 220 360 | gmf@vfsgroup.com.au | www.vfsgroup.com.au

Replay of our Global Macro Fund’s August Webinar

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.