We thought it prudent to give a short overview of our current positions and tap into some of the themes in which we are currently investing and what we see ahead.

If you or anyone you know would like to know more about the themes contained or how to benefit from the strategies of the GMF please do not hesitate to contact us directly.

Join our webinar! Tue, 9 May 2017, 7:00 pm – 8:00 pm AEST

US Tech

The rally in US tech has been a core focus of ours for some time now and our holding in Amazon has performed well on the back of this. Tech in the US is picking up a strong bid on the back of being one of the only sectors generating real and consistent revenue growth.

Background: Over the past few years too many corporates in the US (and globally) have been able to manipulate their underlying Earnings Per Share (EPS) by buying back their own shares and not generating any real (revenue) growth. This has led to a surge in corporate buybacks funded by cheap money (thanks to QE). The market however wised up to this quickly and began rewarding revenue growth rather than EPS growth. Revenue growth is much harder to manipulate and thus a much better indication of the health of a business.

Our long positions in US tech, notably Amazon, continue to reflect our view that markets will reward real growth. Amazon’s recent earnings update saw an EPS beat of nearly 30% with a growth in revenue of around 25%. The stock performed exceptionally on the back of these numbers and we continue to hold.

We make it no secret how fond of this company we are…

Short Australian dollar

Over the past few weeks we have been running a broadly short Australian dollar strategy. This hasn’t been done through direct shorts but rather through leaving our exposure to GBP/EUR/USD stocks unhedged. Our largest exposure has been to the EUR which has strongly outperformed against the AUD. Up around 3% in the past week alone.

The Euro vs the Aussie Dollar. Strong as an ox…

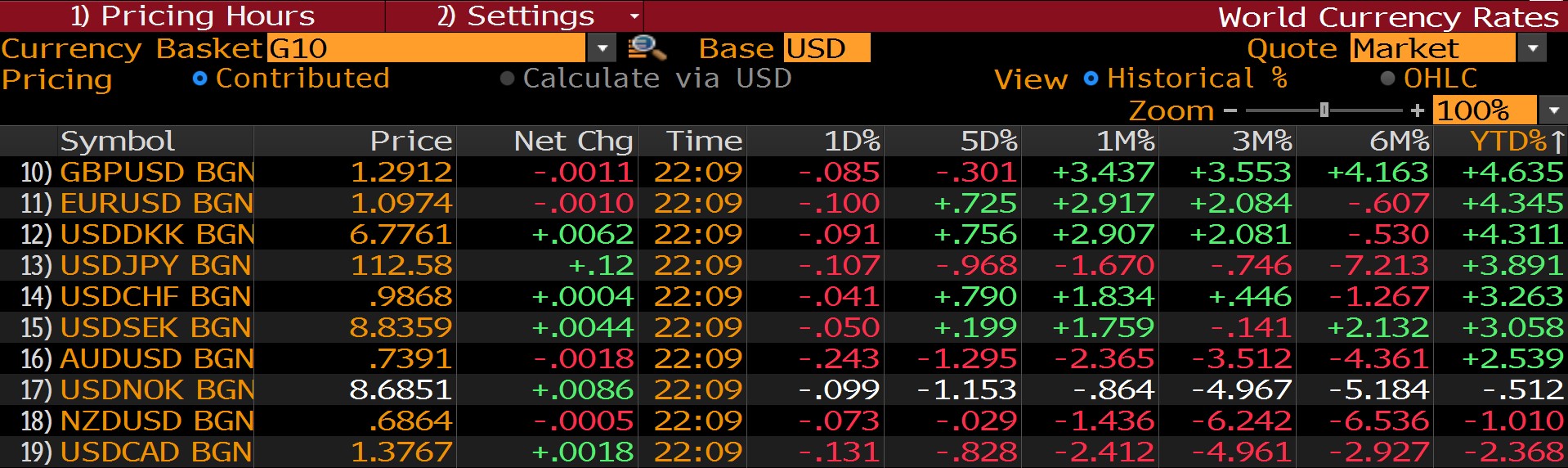

The Pound has been a long term hold for us since mid-January and has also performed exceptionally to be the best performing G10 currency year to date. Note in January our “Long GBP Contrarian call” hit inboxes to much skepticism. We don’t run from mistakes as long as we can crow about our wins.

GBP the strongest of the G10…

Our short AUD thesis is predicated on two factors:

1. Metals– The AUD is primarily driven by metals prices and the rates differentials between Australia and other markets, namely the USA. Over the past few weeks we have become increasingly negative on the metals markets (more on that in the next section).

2. Rates– On the rates side the AUD has traditionally found support through its higher interest rate when compared to the US. Largely driven by an increasingly buoyant US economy and a relatively stagnant Australian economy, this difference has been narrowing quite considerably over the past few months. Adding to the lack of upward pressure on Australian rates has been a recent cooling in the Australian property market. A cooling property market gives the RBA more leeway to hold off on any increase to the cash rate.

Short metals

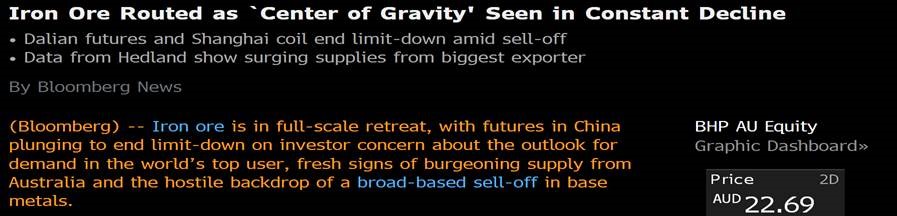

Recent months have seen a significant slowdown in Chinese demand for raw materials. Particularly Iron ore which is currently facing an enormous oversupply.

We have played this theme in two ways. As mentioned above we’ve been broadly short AUD but also more recently through a short position in Fortescue Mining group (FMG).

The below chart shows FMG in orange against the price of Iron ore.

Fortescue moves in lockstep with the price of Iron Ore…

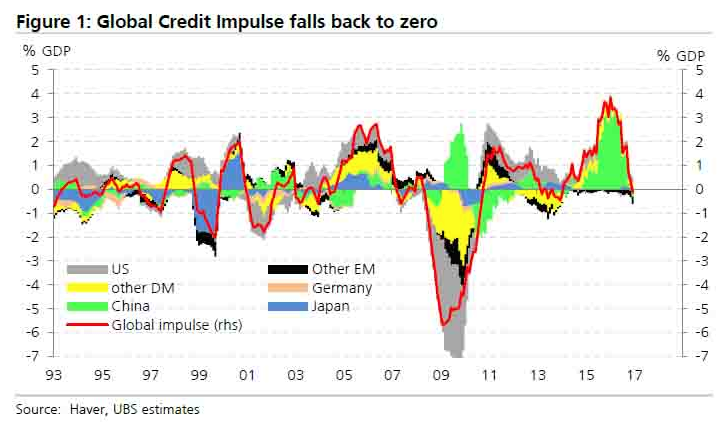

This short position in FMG is part of a broader play on a slowdown in China. Chinese credit has contracted significantly in the past year having grown exponentially the previous year. The chart below illustrates this brilliantly. China is the area shaded green and one can see how fiscal stimulus has dropped significantly.

Chinese credit is contracting…

This is leading to headlines such as this…

Not great for Fortescue shareholders….

Long banks

Our long retail banks theme has been one we have held on and off since around June 2016. Initially our exposure was heavily focused on the US but as US banks started getting expensive we have switched into UK and EU banks. Our banks thesis is relatively simple. In a rising rate environment banks are best placed to benefit from a steepening yield curve.

Put quite simply a bank borrows in the near term and lends out at the long term. The steeper the yield curve the bigger a bank’s margin. Also unlike Australia, US and European banks have not had a rocket fueled credit binge to benefit from. As a result, they are much better placed to benefit from an expansion in consumer credit, an essential ingredient for a bank’s revenue growth. European banks are also cheap (US banks also to a lesser extent) when compared to the Aussie majors.

Our major holdings are Aldermore in the UK, Intesa San Paolo in Italy and Natixis in France. All of these banks have been chosen primarily on the basis that they have clean balance sheets and are well placed to benefit from an expansion in consumer credit and a steepening in the yield curve. (See above) Natixis differs somewhat as it is an investment bank with large exposures to the US.

You can see the performance of all 3 below.

Intesa (white), Aldemore (orange) & Natixis (blue)

Hear our April Bloomberg interview regarding the investability of France

If you or anyone you know would like to know more about the themes contained or how to benefit from the strategies of the GMF please do not hesitate to contact us directly.

All the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

+1300 220 360 | gmf@vfsgroup.com.au | www.vfsgroup.com.au

Charts in black courtesy Bloomberg.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.