We have our own problems. The property market is falling into chaos. Roads are littered with ‘For Sale’ signs and you can’t walk down the street without someone throwing the deeds to their house at you and begging for a two-week settlement.

At least that’s what the BBQ chat would make you think.

Actually we’ve had a bad weekend of clearances last week and the rain in Sydney this weekend won’t do much to help that. There’s anecdotes abounding about an increase of properties on the market and the press is loving it. I’ve noticed properties selling way below their expectations, it’s true. Perhaps it says more about those expectations than the sale prices. I have no doubt that the market has turned a little but it’s not panic stations. Everybody calm down.

Your Sydney property (for those residing or investing in the Emerald city) probably doubled in valuation in the last few years and a cooling is in order. It’s a balloon being slowly deflated, hardly being burst.

Reading James Kirby in the Australian this weekend and he shares a similar view. He mentioned a report by CoreLogic this week which showed that Sydney house prices had dropped 0.6% in the last quarter.

Panic stations? Hardly. Be alert but not alarmed.

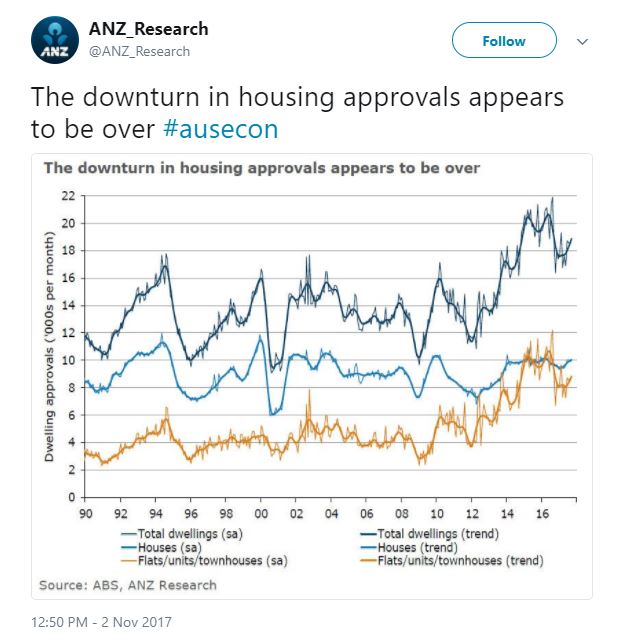

ANZ keeping a cool head here but note this tweet came with the comment from the excellent Jo Masters (ANZ) “The outlook for residential construction is a key point of difference among forecasters at the moment.”

But one of the things I love to do is to “play the tape to the end” when faced with something like this. Let’s just say there is a correction coming. It’s due & needed. After all, corrections help build trends and I’d take an upwards trend in this space over a downwards one any day of the week.

So we correct a little, what happens then? Maybe there’s some tightening of investment property portfolios, investment properties are sold more rapidly and there’s less investment in new builds.

Banks still need to keep lending (because that’s what they do) so the competition to pick up new loans is on. Banks will have no alternative but to cut into their Net Interest Margin to compete and that’s bad news for stock prices and bank-owning super funds.

Macroprudential changes to lending capacity with regards to investors means quite possibly our property market might return to normal. Young people might be able to afford their first home and my long-held “Theory of Stuff” in which economies are held together by young people buying new homes and filling them with new ‘stuff’ comes back into play. Good for them since Harvey Norman’s slashing its prices on refrigerators. (Definitely NOT paid advertising)

Bottom line is that long term I still see the banks as an “avoid” regardless of the duration of this property cooling. Leave aside any banking Royal Commission which would be brutal.

Courtesy Business Insider

Vaguely related to this is my long held view that the Australian Economy is cactus. Property is all we had and that’s cooling. Retail spending is trending down. Debt is still way too high and one of the biggest employers of people have started the sort of GFC-like job-cuts seen around the world a decade ago.

OK, the 6000 cuts announced by the NAB this week are more to do with automation than financial crisis but those are still jobs and wages and mortgage payments being put at risk. It’s also just the start of more to come in the banking space, already far too layered with middle management paper-pushers. You know who you are!

One of our only hopes is that global growth holds and that our resources sector continues to be supported because of it.

Meanwhile our Government is a continuing source of ridicule for so many reasons. Going into the list is too depressing so I’ll stick to the lighter side. I love a good poke at our leaders as much as the next man (maybe more) and this found its way into my Twitter feed. For mine it won the weekend.

Courtesy @_jessticulate

However it’s not all doom & gloom & bad hat jokes. We now move into the best part of the year being post-Melbourne Cup Day markets.

The Australian market moves like it’s on a string at this time of year and I see no reason for that to change. However since I’ve just written it that’s probably out the window but if it holds true there’s nothing like a little seasonality to stimulate the senses.

Hat-tip to the great people at Market Matters for compiling this today which goes into some length. I’ll summarise the relevant details:

Since the GFC, the ASX200 has fallen on average 5.3% in November and gains in December by 2.5%.

Let it happen.

Also getting plenty of questions about my Cup tip. Having glanced at the form today I’m sticking with Humidor.

Stay safe & all the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.