We thought it prudent to put out a short note on what we’re seeing at the moment and whilst I’ll go on with a few lines on the USD & our refreshed look at Europe something hit me last night that took me back to my first day in broking so many years ago.

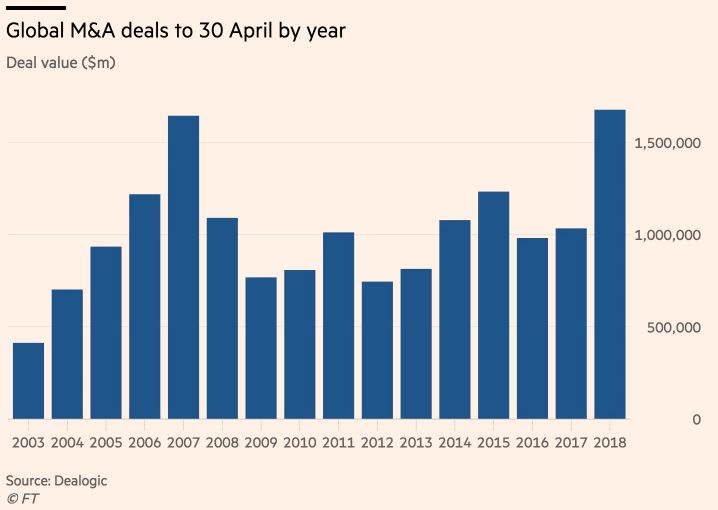

I was reading a piece in the FT on the flurry of dealmaking travelling around the market at the moment. “Merger Mania” saw USD $100m of announced deals in a 24 hour window early this week. This brings the total value of deals in 2018 up to $1.7tn. Read those letters there, people.

Trillion.

Any time I see big numbers like that I always look for the “this is the largest since…” comment in the article.

I’ll let the graphic do the talking for me…

Tallest tower since 2007…

Then came the really good part which took me back to my early days as a junior assistant to the assistant on my first desk.

“Forty per cent of the deals agreed this year have included a stock component, while 14 per cent have been composed exclusively of shares, according to Dealogic. That has pushed all-cash deals to the lowest level in three years.”

This triggered the memory for me. Companies using scrip instead of cash is interesting.

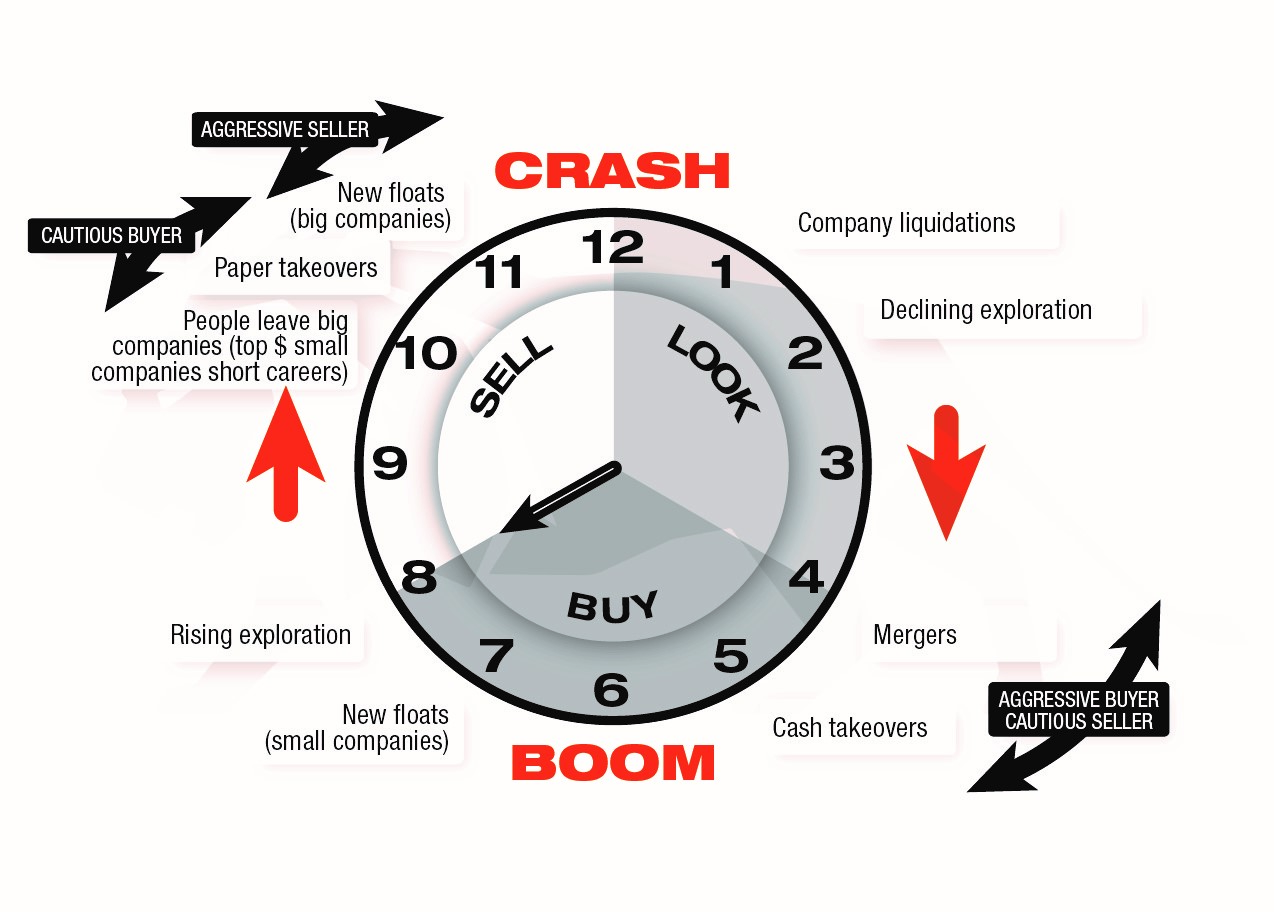

I dug up the first thing I was shown all those years ago. It’s “The Clock” produced by Lion Selection & it gives a sharp overview of the cyclical nature of the mining sector. Here it is.

Courtesy Lion Selection. Note the time is from an old note of theirs.

The clock above is from six months ago and was part of the boom time for resources. BHP rallied ~17% from this time to the end of January.

I think it’s entirely possible we’re moving towards the 9.30-10 o’clock area.

Plenty of wiggle room in that statement.

And yes I admit that the deals the clock references are resource deals and that much of the actual M&A at the moment is ex-resources. I’m not bothered.

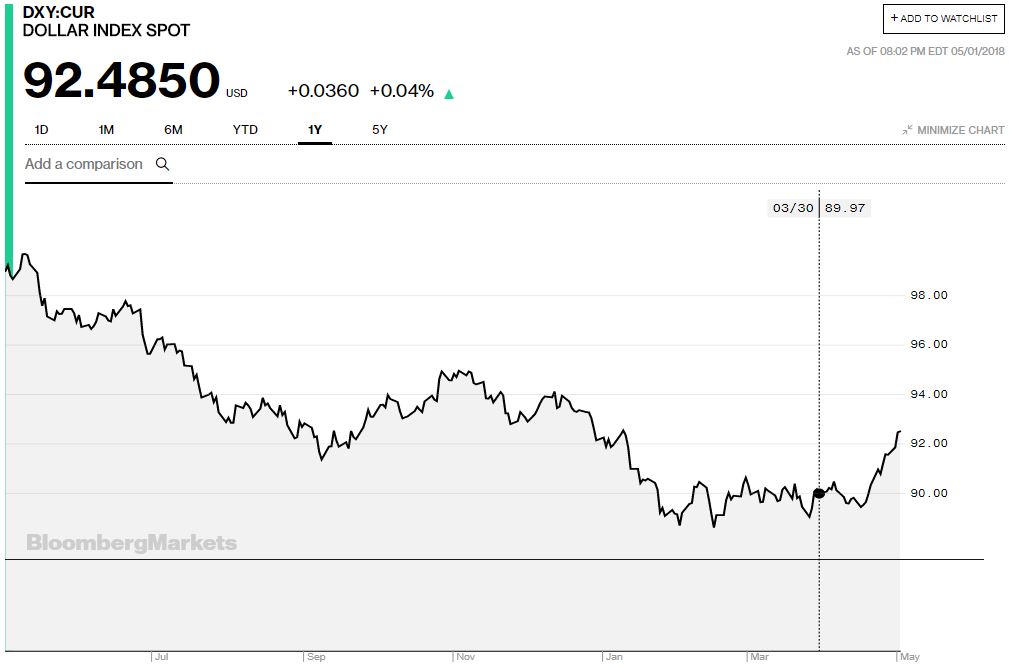

A note a while ago calling for a rally in resources (which proved accurate) used the weakening USD as one of the key reasons. Now that we’re so openly bullish USD it would be remiss of me to discount it as a factor for the potential weakening in resource stocks.

Dollar index over the last year. Courtesy Bloomberg

As you can see it’s moved out of it’s doldrums and has broken resistance. We believe it will continue, possibly making it the trade of the year.

The Fed meets this week & whilst the market expects no new news tomorrow morning there is strong sentiment that they’ll use the meeting to wink-wink/nudge-nudge towards stepping up the pace of tightening for the rest of the year.

Yes, inflation is back in the US and it’s not blowing the roof off which is great.

It’s rising at a nice steady rate of 1.9% in March vs a year earlier, which was up from 1.6% in February.

Whilst this is narrowly under target, the market is comfortable with the way it’s travelling.

Note that crude ripping higher has a bit to do with this too and my conspiracy theory on this has much to do with the Saudi’s and the Aramco listing but that’s for another day.

Also adding weight to the USD rally is the unwinding of USD short positions, which 2 weeks ago were at multi-year highs. The unwinding of said shorts is already happening and it’s given this USD rally another leg up.

More to come.

Meanwhile in Europe….

So the USD will continue to rally which means theoretically the Euro drops which means we’re getting back on the long side of Europe. We started buying on Monday and will continue to do so for as long as it works. Remember ~50% of European listed companies’ revenues come from exports so a weakening Euro helps those companies. We try not to make it too complex here.

All the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.