If you would like to book in a no-obligation consult to discuss your options for wealth creations, then please feel free to book in a 15 min appointment, by entering your details below and nominating a time that suits you:

Lets talk about how we can help!

Here at VFS we specialise in retirement and investment planning.

The volatility of 2020 showed that in the battle between actively managed and passively managed portfolios that actively managed stood head and shoulders above passively managed. Our active portfolios were able to move to safety early and re-join the market as when we saw fit, in the sectors that had the best risk vs. reward scenario.

Examples of fundamental research may include but are not limited to the flow of funds, sector rotation, changes in rates expectations, changes in economic performance, and political change.

The Global Macro Fund will make use of tactical positioning to benefit from short term price changes. The Fund’s Portfolio Managers make use of strategic positioning to benefit from longer-term changes in price.

Strategically, the Global Macro Fund will take advantage of macro themes. These themes may use a number of different strategies, with the aim of achieving a positive absolute return.

Risk Profiles

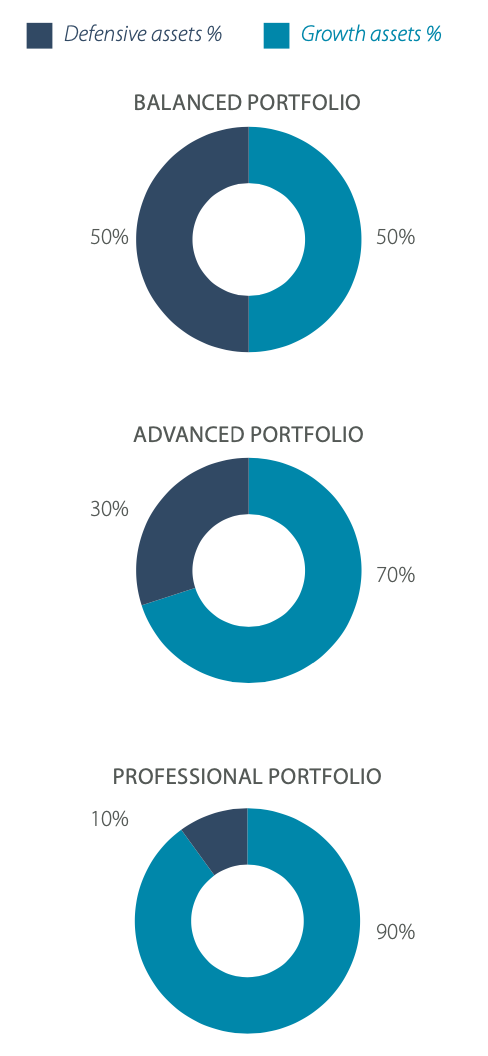

The VFS Global Macro Fund has been developed to meet the needs of a range of investor profiles. The three strategies of the Fund allow us to match a portfolio with an investor’s risk profile.

The Global Macro Fund is not suitable for conservative investors, while the objective of each portfolio is an absolute return, this cannot be achieved without a longer-term time horizon in mind.

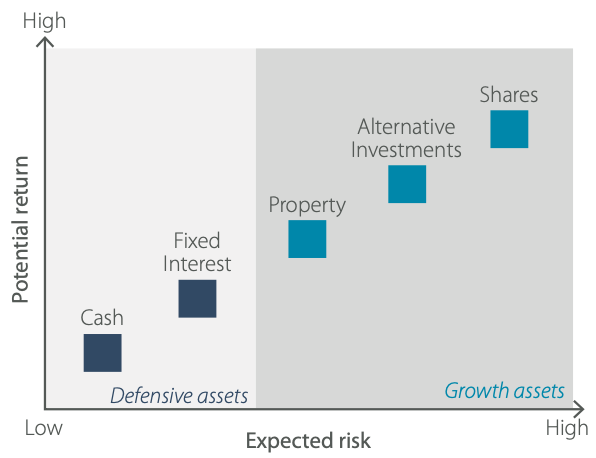

An asset class is a specific category of assets or investments, such as cash, fixed interest, property, alternative investments, and shares. These investments fall into two broad asset categories – growth and defensive.

The diagram following shows the traditional manner that each asset class is categorised into based on its risk characteristics.

Growth Assets

Within the Balanced Portfolio, the target allocation to growth assets will be 50%.

Within the Advanced Portfolio, the target allocation to growth assets will be 70%.

Within the Professional Portfolio, the target allocation to growth assets will be 90%.

Defensive Assets

The Portfolio will utilise high yielding equities and will use derivatives to dampen volatility and protect capital. The idea behind this type of defensive strategy is to ensure an appropriate level of risk in order to target steady returns.

Each macro strategy will allocate funds to cash, fixed interest assets such as term deposits as well as hybrids. The hybrid components will always be listed assets and will have a high level of liquidity, which is in line with the overall portfolio philosophy.

Within the Balanced Portfolio, the target allocation to defensive assets will be 50%. These defensive assets will be made up of hedged, high yielding equity positions, cash, fixed interest, hybrids, and corporate bonds.

Within the Advanced Portfolio, the target allocation to defensive assets will be 30%. These defensive assets will be made up of hedged, high yielding equity positions, cash, fixed interest, hybrids, and corporate bonds.

Within the Professional Portfolio, the target allocation to defensive assets will be 10%. This 10% will typically be made up of cash.

The allocation ranges are a guide only. The Portfolio Managers assess the global environment and allocate to growth and defensive assets as appropriate.

Asset Allocation Range

An asset allocation range is a minimum to the maximum percentage that can be held in the asset class. Given the nature of the Global Macro Fund, the range for every asset class is zero to 100%.

An investor can expect that the long-term allocation to each asset class is in line with the target allocation shown in the diagram above.

Asset Allocation

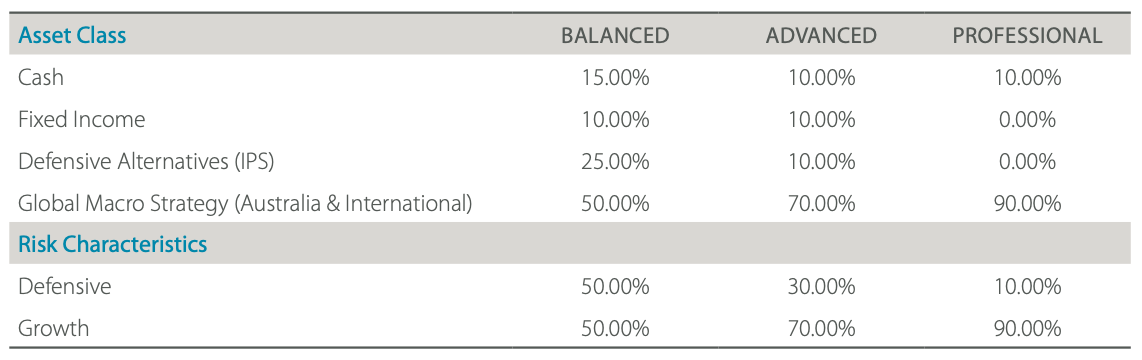

The table below illustrates the target asset allocation for each Global Macro Fund. The asset allocation illustrates that these portfolios are exposed to the global equity markets with options used to change the risk characteristic of a portfolio.

This is particularly evident in the Balanced Portfolio where the IPS allocation is 25% of the value of the portfolio.