Japan has always been a country with which I am fascinated. Almost certainly this was inherited from my father who dealt with Japanese companies for most of his career and much of this rubbed off on me. I’d like to hope my dealings in business and life reflect his tutelage.

So it was with interest I read in The Economist over the weekend about the current trend of expectant mothers to opt for doctors over midwives and painkillers over the absence thereof. Apparently women are traditionally expected to endure the pain of childbirth in order to better the bond between mother and child and prepare the mother for what lies ahead. I’m not about to question centuries of Japanese Buddhist tradition but as a long time reader of The Gartman Letter I’m always interested in fertility rates of advanced countries, on which this article touches. Japan, with a fertility rate of 1.5 children per woman and a non-existent immigration policy, has a has a declining population. A country requires a rate of 2.1 to replace its population and the Japanese Government is keen to get theirs at least up to 1.8 per woman.

How they plan to get that done is a whole issue in itself. The issues the next generations have to face from an ageing population will be numerous and long-term.

Locally…

The fallout from our own housing bubble continues with affordability again making the front pages. This time avocadoes are somehow to blame but single-seed berries* aside we do have an issue with young people owning their first home.

I’ve long been an advocate for young people owning their own home based on what I call my “Theory of Stuff.” When you own your own place, you fill it with “stuff,” and buying “stuff” is great for economies. Not owning your own home means you meander along with mum’s borrowed toaster which you’ll struggle with for as long as possible before replacing. Basically, young people owning their own place = good long term economics.

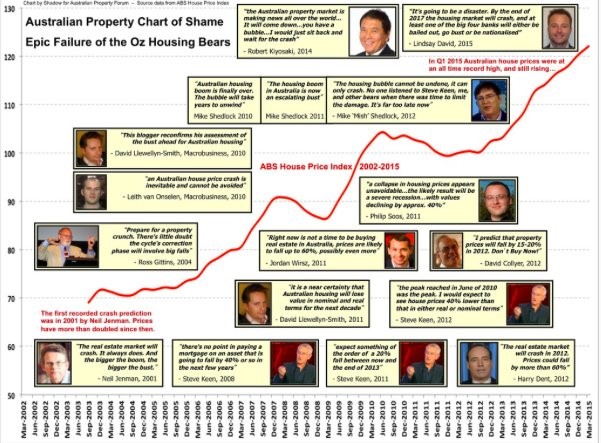

Regardless, the Australian Housing Bubble continues and I’m loathe to add my name to the list of top callers below.

Courtesy Australian Property Forum via Stephen Koukoulas

What I’m more interested in is how individuals are going to be affected by the changing direction of global interest rates. The best way to assess this is to look at the future for retail banks.

I will play the tape out as I see it at the moment similar to what I argued last week on Business Insider’s weekly podcast

US situation

Jobs: good

Economy: ok

Rates: basically zero

Banks: slimmed down on staff and other costs, hyper-regulated

Bank margins: non-existent

Future view on rates: uppish

Slimmed-down banks’ future margins outlook: good

Simply, US retail banks have had to slim down on people as margins shrunk and confidence contracted. Now rates are set to go higher (December rate rise

Australian situation

Jobs: not great

Economy: been better

Rates: low

Banks: No significant trimming down, regulation coming thick and fast

Bank margins: not amazing but still ok

Future view on rates: bottom of the cycle

Personal debt: extraordinarily high

Mortgage situation: highest arrears levels in three years

Rate rise pressure on borrowers: very, very bad.

Simply, our credit cards are maxed out and any extra burden to what we already have to pay our banks could just tip us over the edge.

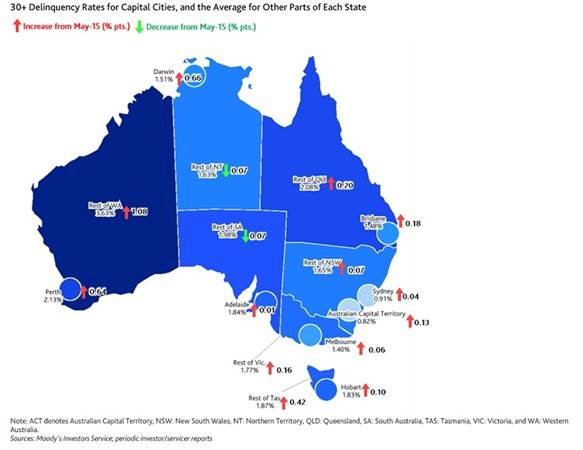

Exhibit A:

We’re falling behind on our home loans with residential mortgages more than 30 days in arrears now the highest in three years. http://www.businessinsider.com.au/australian-mortgage-arrears-are-at-a-three-year-high-2016-10

Exhibit B:

A widely known move by the banking regulator is now in place and requires new borrowers be assessed at a borrowing rate of 7%. This isn’t really new news but shows the ongoing theme that the regulator is putting the squeeze on already twitchy banks regarding who can and can’t be lent to- http://www.smh.com.au/business/banking-and-finance/apra-locks-in-tougher-mortgage-rules-to-ensure-prudence-of-banks-20161024-gs964b.html

Exhibit C:

Certain postcodes have been and continue to be black-listed. Again not new news but another strong sign banks are dubious about certain areas and more so on repayment capabilities- http://www.news.com.au/finance/real-estate/buying/nab-blacklists-loans-for-properties-in-risky-suburbs/news-story/23504712c5868d7a6a4c0d10d9d4d028

The simple trade based on the above is to go long US retail banks and long Australian debt collectors/debt consolidators. I’ve been positioning clients in these stocks for a little while and will continue to do so. The US is geared for banks to benefit from rising rates, we are not.

Overall re volatility….

As I read through the weight of research and commentary this week a definite theme slapped me right in the face.

Right now, nobody knows what to do. We are a market starved of direction.

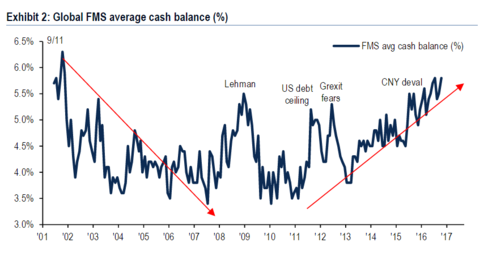

Volatility is low. Very low and single stock direction is being dictated by AGMs. That’s a really bad place to have a portfolio in “set & forget” mode. It’s not just us in Australia or those in the retail space either. Cash levels for fund managers hasn’t been this high since post-9/11. http://www.bloomberg.com/news/articles/2016-10-18/investor-cash-levels-jump-toward-levels-not-seen-since-9-11 with a scary looking chart included.

There’s cash on the sidelines and it’s holding off pending a result on everything. I don’t see it going back in to the market this year.

A current example of low volatility causing overreactions is what we’ve seen what happen on health care last week where one stock reports badly and the rest of the sector shares the pain.

Which in turn brought the same result to similar stocks.

Friday’s health care shock brought about plenty of falling knife-catchers and fair enough, too. If a stock is overdone it’s occasionally worth grabbing some stock and waiting for the bounce while everyone figures out what’s going on. Long term though there’s been a shift in forecasts regarding hospital numbers and the number of people opting for elective surgery. Credit to Market Matters on Monday for putting the dramatics of it all into the sort of context I like to see.

“Another more simplistic way to think about this could be to picture someone with a bung knee needing elective surgery. You can hobble around for a time – a month, maybe two but sooner or later you’ll need to actually pony up and have the procedure. In our view, although the near term might be somewhat cloudy we continue to think that the core industry drivers are intact – the company has some very good projects nearing completion, the balance sheet is sound, and of course, November/December is a very seasonally strong period for the healthcare sector – following a weak October.”

It’s tough to disagree with this view. One quarter of data does not a year make. (Unless of course it does)

Stay safe and all the best,

James

*Avocados are a single-seed berry.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.