Locally

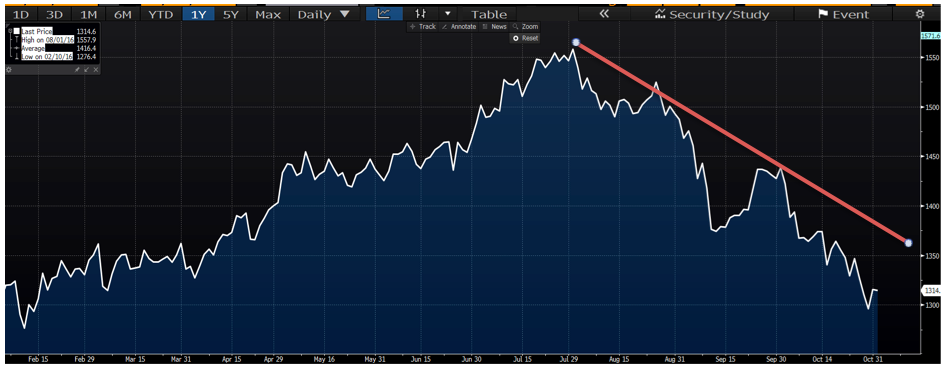

October was a shaky month for the ASX200 which underperformed most major indices, finishing the month down around 3%. The market shot down to 5200 where there is clear support but whether it can hold this level leading into election week is another story.

XJO (ASX200) Chart:

Sector Analysis – Best and Worst

The selling was fairly wide spread although the Industrial and the Property sectors continued to underperform the broader market and finished the month down a whopping 7.09% and 8.3% respectively.

Property Sector Chart:

Industrial Sector Chart:

There has been a clear shift of sentiment surrounding these sectors as a rate rise in the U.S. before the end of the year is looking like a stronger and stronger possibility, which is having a negative impact on yield stocks.

Many stocks in these sectors have been trading at high valuations for some time and have had extremely strong runs over the past two years. Historically, these stocks have relatively high dividend yields so as interest rates have been dropping globally, these stocks have maintained an attractive status. The tides have somewhat turned for these – once were gems of the market – resulting in heavy selling within both these sectors.

Higher interest rates will make other asset classes, such as bonds more attractive as the returns tend to increase as rates rise. The Materials sector put in a good effort locking in a gain of 0.6% which is an outperformance of the ASX200 by 2.72%.

Materials have been the diamond in the rough this year which is somewhat ironic given their consistent underperformance since 2011.

Materials Sector 5yr Chart:

We maintain our view that investors should err on the side of caution and employ strict risk management strategies to portfolios and be diligent with exiting positions according to plan. That also includes avoiding greedy decisions and opting for locking in gains when stocks reach profit targets. November is a huge month for markets with U.S elections taking place next Tuesday the 8th and all eyes will be closely watching the polls leading into this event.

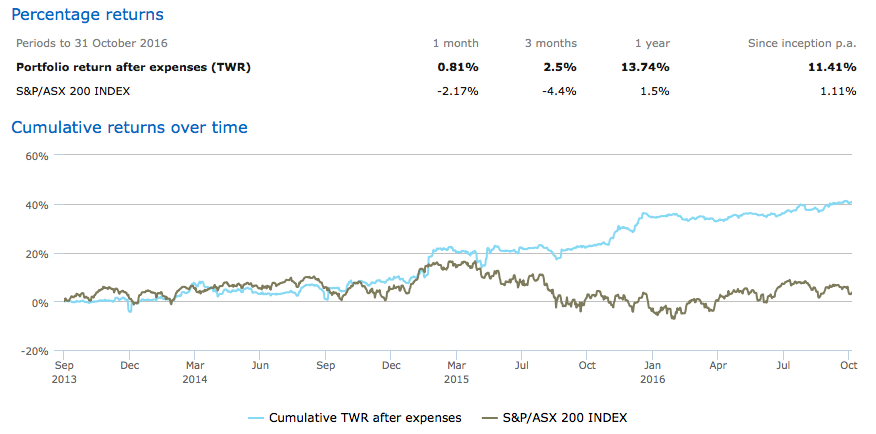

Growth Portfolio

Our Growth Portfolio continues to outperform the market substantially and achieve solid returns for investors.

ALS Limited (ASX:ALQ) continues to do well and is currently running at a 6.85% profit which is a huge effort from the stock considering the market was down nearly 3% for the month.

We recently added TPG Telecom (ASX: TPM) to our Growth Portfolio after the stock experienced a 40% fall form highs reached earlier this year. The stock has reached oversold territory and we feel it offers far better risk reward at current levels.

Our diligent stock selection involves a lot of research and analysis and our trading methodology ensures strict risk management strategies are employed before we enter into a position. This allows us to let profits run when things go our way and to keep losses to a minimum when they don’t.

We have been very cautious leading into the U.S. elections as we feel there will be plenty of time to identify good opportunities post the election hence our unwillingness to try and pre-empt the result and increase our equity exposure before next Tuesday.

Overall, our Growth Portfolio has booked in returns of 11.41% p.a. after expenses over the past 3 years compared to 1.11% by the ASX200 which is an outperformance of the market by 10.3% p.a. NET since September 2013.

Options Corner

The key upcoming event in the options market is next week’s US election. Uncertainty over the result has led to a big increase in the VIX (the Volatility Index) which has risen from subdued levels of around 12% up to 22% over the past week, a near doubling. Volatility has a big impact on option pricing, so it’s critical that our strategies take this into account.

The big question is how do we see the markets playing out over the next couple of weeks?

If we take a look back to Brexit earlier in the year we can get an idea of potential outcomes. Volatility spiked around Brexit, but it was followed by an equally sharp fall in volatility and markets rallied strongly. As such we are expecting that volatility will peak in the days leading up to the result being known.

If Clinton wins we would expect a reasonable rally in the markets, and would expect volatility to fall quickly back to levels seen a few weeks ago, i.e. in the 12-15% range.

If Trump becomes president we think the initial reaction will be negative, and this will lead to volatility levels remaining elevated, albeit falling slight from current levels, i.e. In the 15-20% range.

One of the strategies we use to minimise the impact of volatility is the use of spreads where we are selling one option and buying another. This way the pricing of both options will be affected by a similar degree, thus negating some of the impact on the spread due to increasing or decreasing volatility.

Another strategy we have used very successfully in the past is to create strategies than benefit from falling volatility. The key to this is entering trades when volatility is peaking and this is something we will be alert to next week.

Looking forward we do expect markets to be higher in December & January; the only question is how low they fall in the meantime.

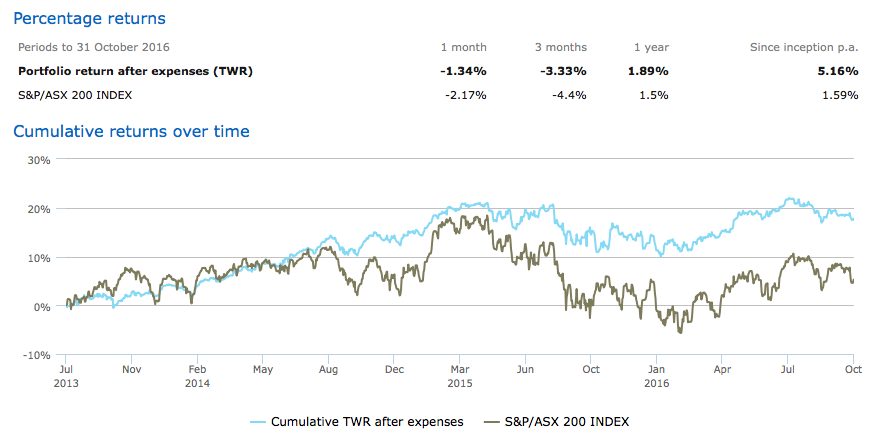

Income Protected Portfolio

There were no new positions added to our Income Protected Portfolio during the month of October as we continue to be patient and wait for good opportunities to present themselves.

For this strategy to be effective, one must be disciplined with entering positions and ensure entry criteria is met.

The portfolio currently holds BOQ, CBA, SGP, TCL and TLS.

The selloff in October has created some good buying opportunities however the upcoming U.S election is a concern thus we will more than likely wait until we get a result and see how the market reacts before adding positions to this portfolio.

The portfolio continues to outperform the index and continues to produce consistently good results.

For more information, please call 1300 220 360.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.