We thought we would review a few of the major talking points in September as equity markets experienced volatility for the first time since May when Brexit was at the forefront of investors’ minds.

Locally

After the previous months reporting season investors were looking overseas again for leads. Volatility roared back into the market on speculation that the US would raise interest rates at the September meeting (see below).

Of those stocks that did report during the month we saw two market darlings fall from grace. TPG Telecom and Vocus Communications both fell on the back of lower future earnings.

On TPG the margin they make on consumers is largely the result of a $15 copper access price and over the next three years most of that business will migrate to the NBN, where they pay a $43 access price.

So you have a triple header. Stock market darling priced for perfection, disappointing future guidance (lower revenues) and finally the admission that the roughly 40% margin they’ve been operating on is going to drop quite considerably.

In light of all that it isn’t surprising to see a 21% decline.

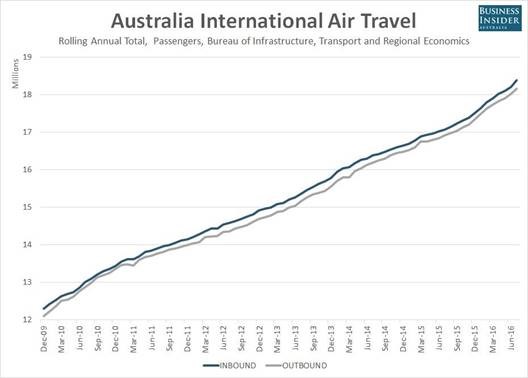

Telstra is still the dominant force making up over 90% of the telecommunications index. Below I have looked at the comparison between Telstra and the telecommunications index

- TLS

- Telecommunication Index

Source: Bloomberg

The Bank of Japan

The Bank of Japan added “yield curve control” to its monetary stimulus arsenal, and pledged to expand the monetary base until inflation overshoots its 2% target. The surprise move is aimed at reducing the strain on bank earnings from its stimulus. The decision was initially negative for the yen and positive for stocks. In our view, the shift is unlikely to give an immediate boost to inflation, though it could ease concerns about the sustainability of the BOJ’s easing program. Implementation is likely to entail risks, given the difficulty involved in trying to control long-term bond yields.

The new framework has two main components:

“Yield curve control” under which the BOJ will try to influence short- and long-term interest rates. To this end, the BOJ kept its negative policy rate at -0.1%, and will aim to keep 10-year JGB yields around the current level of about 0%.

The BOJ also committed to expanding the monetary base until inflation remains stable above 2%.

Source: Bloomberg

On other components:

The BOJ said it would keep the annual pace JGB accumulation more or less in line with the current pace of about 80 trillion yen

ETF purchases remained at about 6 trillion yen, in line with BI Economics’ forecast

J-REIT purchases were held at about 90 billion yen, in line with BI Economics’ forecast

The BOJ scrapped the target for the average remaining maturity of its JGB holdings

The shift to focus on the yield curve could enable the BOJ to keep its monetary easing framework in place for a longer period of time. Still, the BOJ may start to run into limits on its JGB purchases by the end of 2017. Given this looming constraint, we expect the central bank will need to take further measures to make its framework more sustainable.

The Federal Reserve

Federal Reserve Chair Janet Yellen braved mounting opposition inside and outside the U.S. Central Bank and delayed an interest-rate increase again to give the economy more room to run.

While agreeing that the case for a rate rise had strengthened, Yellen argued that it made sense to put off a move for now amid signs that discouraged Americans who dropped out of the labour market are returning and looking for work.

“The economy has a little more room to run than might have been previously thought,” Yellen told a press conference in Washington after the Fed’s two-day meeting, as she explained the decision to keep rates on hold. “That’s good news.”

The decision to stand pat drew dissents from three voting members of the Federal Open Market Committee — the first time that’s happened since December 2014. It also comes on the heels of an accusation by Republican Party presidential nominee Donald Trump that Yellen is deliberately keeping rates low to help make President Barack Obama look good in his final year in office.

When asked about such accusations, Yellen repeatedly disputed that political considerations played any role in Fed decisions. “We do not discuss politics at our meetings and we do not take politics into account in our decisions,” she said.

The Fed chair also made clear that the central bank still intends to raise rates this year. “I would expect to see that, if we continue on the current course of labour market improvement and there are no major new risks that develop,” she said.

Rate Path

Not only did the Fed put off a rate increase, it also scaled back the number of hikes it expects next year, to two from three, according to the median forecast of FOMC participants released after the conclusion of the two-day meeting.

Weak Productivity

Yellen also argued that monetary policy was not exceptionally easy, in spite of the low level of interest rates. That’s partly because slow productivity growth and an aging workforce have reduced the economy’s potential growth rate and thus its long-run equilibrium interest rate.

“Monetary policy is only modestly accommodative,” she said.

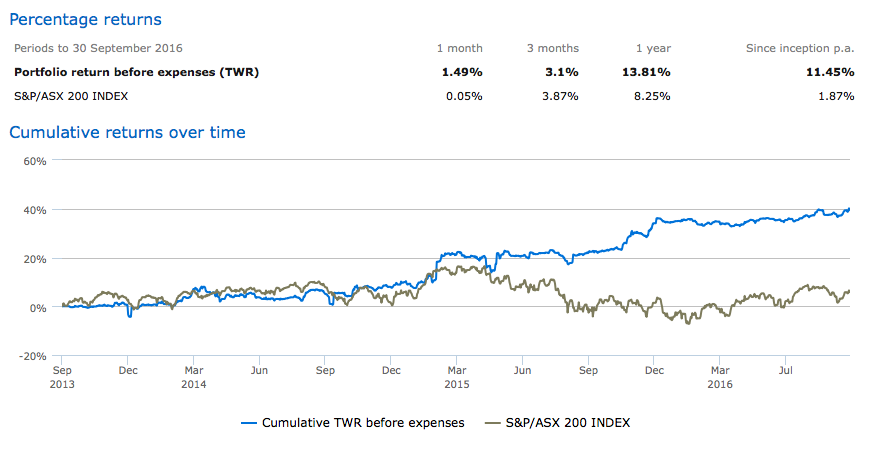

Growth Portfolio

For the month of September we managed to gain 1.49% compared to the index which was flat. The trading involved taking no losses and only locking in profits. These included a short term trade on the Bank of Queensland and closing our exposure to the Nasdaq.

We are currently up 8% on Challenger Financial Limited and are showing a small profit on ALS Limited ALQ. ALQ has been erratic since we entered the position, reaching yearly highs before pulling back. The momentum is strong with both of these positions, in particular CGF, where the prospect of higher interest rates in the US is pushing the stock well above our entry price.

For clients who are trading our international recommendations we are currently long Facebook, Amazon in the US and Tencent Holdings in Hong Kong.

Growth Portfolio Returns

Options Portfolio

Options trades have been a big contributor to performance over the September quarter despite having flat performance for the month.

September was characterised by falling markets in the first half, followed by a strong rally in the second half. This made for a reasonably tricky month for trading options, as the falling trends quickly reversed.

We did enter a number of shorts early in the month but were stopped out on these for small losses. In terms of the XJO we were on the right side of these moves, however our strategy was designed for a longer slower decline than we saw and this lead to our profits being modest despite having short positions in place at the start of the month.

In the second half of the month we switched to long positions on the XJO and Newcrest, and we saw these move favourably over the past couple of weeks.

With options, the strategy we choose can have a significant impact on the profitability of the trade. It is not just a case of picking the right direction, but also selecting the right timeframe for the move and trying to predict the strength and speed of the move. It is combining all these factors together that make options trading so challenging. Like a 3-D chess game within the framework of challenging markets. With the strategies we choose, we try to minimise the downside while still enabling us to make strong profits if the stock moves in our favour. Finding the balance between risk and reward can be a delicate balancing act that we are always striving to master.

For more information on these portfolios or to speak to a Wealth Advisor, please call 1300 220 360.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.