I thought I’d take a little time out on the first note of the year to talk about commodities & the year ahead. There’s a few things I’d like to present for your opinion and discussion.

Over the break I spent a great deal of time thinking about what my “theme o’ the year” will be. 2017 was a continuation of our US banks view and a negativity towards the Aussie retailers and serious caution on the local banks as well as lithium, lithium & more lithium.

This year I’m bullish the global commodity space and there’s a few things I’ll throw together to back it up.

Firstly: USD weakness = commodity price strength. For those who know this: great. For those that don’t: trust me it’s a thing. All things being equal, strong dollar means weaker commodity prices & vice versa.

So what’s our view on USD?

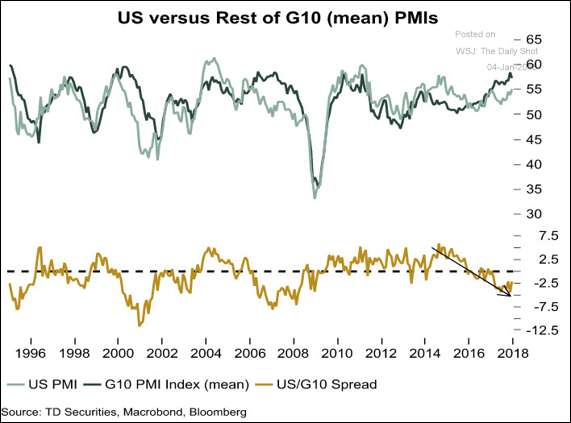

Weaker for a few reasons. Firstly economic activity in the rest of the world is now outpacing the US. I’ve banged on about Europe before and the PMIs out of there but this is a great chart posted on ‘The Daily Shot’ from TD Securities that shows just how far the gap between G10 countries & the US is with regard to PMIs.

Source: TD Securities & The Daily Shot

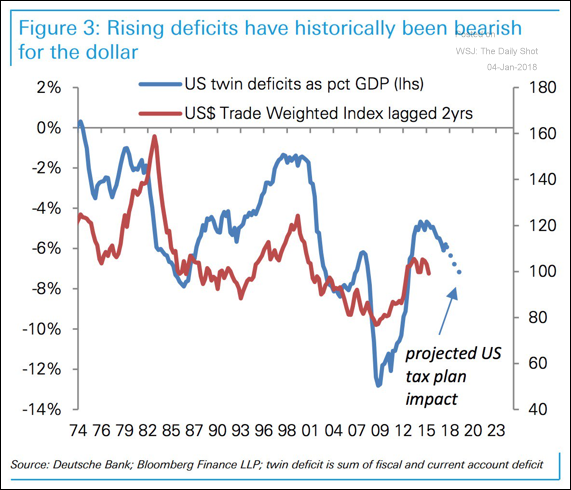

Also adding to potential USD weakness is the historic tendency for rising US deficit causing USD weakness. This chart from Deutsche Bank outlines the twin deficits of the US vs the USD Index lagged two years.

Courtesy The Daily Shot

So that’s USD weakness. I’m happy to put aside any talk of the Fed raising rates. I think the only thing that the Fed can do to lift the USD is to rapidly increase rates ahead of expectations and that would only bring about a whole other set of problems. They don’t want this to happen.

Note the potential downside risk on the horizon that if US CPI (updated this Friday) remains muted, added to the down trending US jobs numbers, we may see a revision of expectations on how many rate rises the Fed conducts in 2018.

That’s great if you tie it together with the last part of this note on wages.

Secondly, copper.

It’s bullish for a reason. Here’s a chart of Copper for the last year showing the strength it’s had since May last year. We’re not inclined to chase this every day but happy to keep accumulating on pullbacks.

The copper price is telling us that something’s going on in the real economy. Inflation may actually, heaven forbid, be getting a lift.

Also, (and it could easily be a reverse indicator) but “the market” agrees, with speculative longs on copper recently touching record highs.

~160% in 7 months in a nice, orderly, “bottom left to top right” fashion. Courtesy Bloomberg

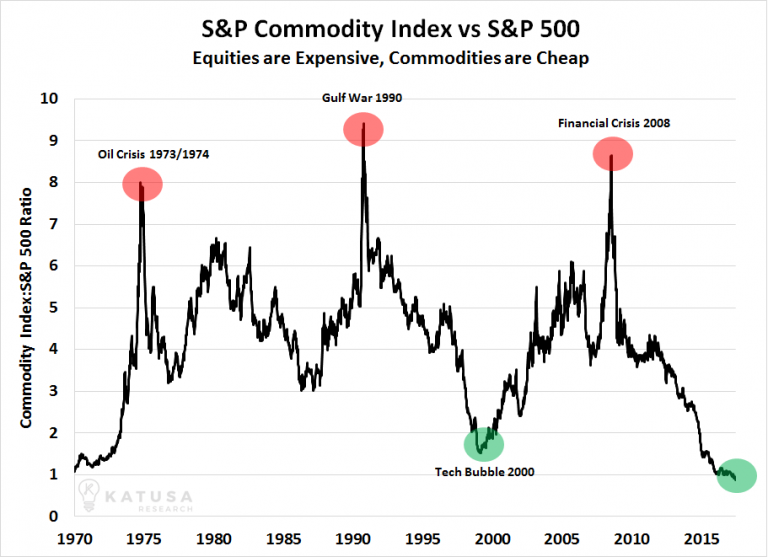

Thirdly here is the chart that’s been replayed more times than the former PM drinking a beer at the cricket.

Note: Ratio charts are funny. They don’t give an indication of timing, just of extent. So when you see a ratio chart like this don’t jump the gun and get contrary, just settle in and get ready to reverse your direction.

This chart is the ratio of the commodities index to the S&P, and while it’s a little dated the divergence is still about right. Normality needs to be restored eventually.

Plenty of upside for commodities but downside for the US market too.

Fourthly (is that even a word?), inflation. Historically speaking being long commodities is a great way to hedge against inflation. Inflation goes up, it erodes real asset returns but commodities go up. Buy commodities if you think inflation is on the rise.

There are numerous ways to gauge if inflation is on the rise, (breakevens, lumber, copper, actual inflation gauges etc) and we take all of the relevant indicators in. I’m always keen to keep an eye on wage growth. If consumers don’t have more money in their pocket than the rising cost of goods becomes a difficult but moot point.

I need people to be getting paid more to start getting excited.

So when I saw this quoted in the very smart Greg McKenna’s (AxiTrader) daily briefing I felt a little tingle in my gut. Here’s the Bloomberg article Greg referenced:

https://www.bloomberg.com/news/articles/2018-01-08/recharged-shale-boom-in-2018-still-faces-shortage-of-frackers

The shale industry in the US is finding it hard to get crews due to the tightness of the labour market. A tightening labour market is great for upwards wage pressure.

This all ties in very well with rising inflation, which is being displayed in rising commodity prices, which also provides a great hedge against said inflation.

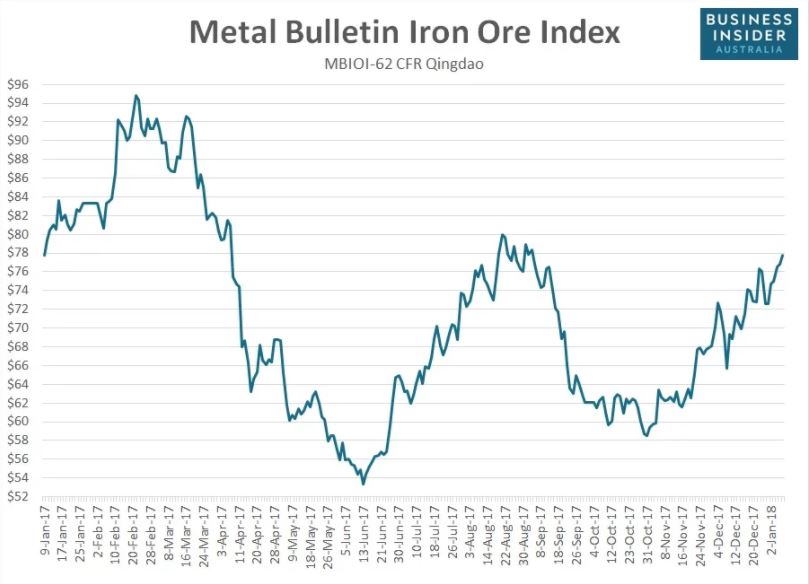

I’ve been taking action in the copper and diversified mining spaces (as well as lithium obviously) and they’ve been serving us well. I leave you with the iron ore price which I didn’t even get around to!!

Remember China??!!

If only there was a listed Aussie company that had exposure to iron ore, copper and a whole host of other commodities….. Courtesy Business Insider

Stay safe & all the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.