I was recently reminiscing to colleagues about my first job in broking all those years ago. In my first week a senior dealer helped me out by slinging me a few books as mandatory reading for a junior junior assistant to the assistant, as my role was termed.

One of them was “One Up On Wall Street” by the legendary investor/fund manager Peter Lynch.

I was reminded of Mr Lynch’s great work as I was speaking to some colleagues about the banks’ eventually getting out of their extraneous wealth & advice divisions & how it reminded me of something from the past.

I let it stew for a while but I believe I have the beginnings of a controversial idea….

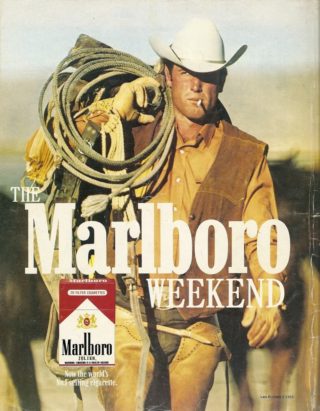

I’d like to take this opportunity to point out that four “Marlboro Men” have died of smoking-related diseases….

In Peter Lynch’s seminal work there was the example of the panic that ensued in tobacco stocks when new advertising laws were passed restricting what big tobacco could say in ads. The original thought was that if cigarette companies couldn’t advertise they’d be damaged. This was based purely on the reasoning that tobacco needed advertising to get people to smoke and also to compete for a bigger share of the lucrative smoking market.

I can’t find my copy in the office but this is how I remember the trade going….

The stocks were beaten up on this new regulation and then the great Peter Lynch moved in with one of his amazing plays based on a very simple philosophy:

If one cigarette company was restricted from advertising that would be one thing, but if they’re all restricted then the buy is obvious.

They spend a fortune on advertising their brands to compete with each other. Now, by force, that huge expense is stripped out and goes straight back to the bottom line. If they’re all disadvantaged the same then they’re all advantaged the same. The bigger tobacco companies more so because they already have the brand reputation which sells itself.

But what about getting people to smoke in the first place?

They’re CIGARETTES. People will smoke them.

Turns out it had nothing to do with this guy….

So what does this have to do with banks?

Our amazing banks have managed to set up a life for themselves with a great deal of time & energy devoted to non-bank things. Since I’m writing for a broking audience let’s have a look at that sector: CBA has CommSec, NAB has NabTrade, ANZ has ETrade, Westpac has its online trading platform (where service & trades are done by CommSec Adviser Services in an interesting deal) and Bendigo Bank has its online platform and also owns the top margin lender Leveraged Equities.

That’s just a glance at the broking space for banks. What about wealth management, advice, planning and accountancy?

CBA owns Bankwest, Colonial and Count Financial to name a few of these distribution “feeders” as I call them. Count has 300 accounting firms sitting under their license.

NAB owns MLC & JBWere.

WBC owns a whole lot of things that if I said how I feel about them I’d almost certainly be sued so I’ll just say that when I hear the word “Asgard” mentioned my eye starts to twitch.

You get the point…

So let’s review the latest chat around the industry.

ANZ have sold ETrade to CMC Markets

NAB are looking to offload MLC

CBA are looking to offload Count and Colonial First State Asset Management.

Mac Bank have just walked ~50 good advisers and planners out the door in a huge shakeup of their Private Wealth/Private Bank space.

There is more to come. They’re getting in early.

Either by force or by choice I honestly believe that no bank will own these extraneous feeders. Vertical Integration will be a thing of the past for the banks.

When I’ve mentioned this to people the immediate response is that it’s a negative for the banks. No feeders, no forced distribution, bad for business.

My contrary mind thinks of all the grief these extraneous businesses gave the banks.

Remember Storm Financial giving all that grief to the CBA & Macquarie? How about the rogue planners at CBA that caused the Open Advice Review to happen? Not to mention online & retail brokers that are fraught with compliance issues. (CBA featured again here- weird coincidence)

Compliance costs a fortune if you don’t have a compliance culture and I’ve seen some brokers (obviously not VFS Group which is why I’m here) that are complaints waiting to happen.

Again, you get the idea.

I heard an anecdote from a friend who was presented to by NAB boss Andrew Thorburn speak recently where he said something along the lines of MLC being 4% of earnings but 40% of compliance obligations.

The feeling is that without these feeders the banks will lose business. But in a similar vein that debt is like nicotine people will still need the big banks for their banking needs. We still need somewhere safe to park our money & transact easily. We still need to get a loan to buy a home. Despite the kicking, businesses will still need money to grow.

We’ve banked with them for generations & that won’t change.

So the banks now have their “tobacco moment” ahead of them as they offload these compliance drags and can focus on core banking services. Just because they don’t have the forced business coming from wealth & advice they will still be the best places to go. They’ll just need to be more competitive.

So after writing for two years about how a Royal Commission would bring untold destruction on the big four am I now turning around on my view?

Our “War on Banks” piece from two years ago which Business Insider dubbed “provocative”

Click Here

Is it time to buy the banks? No. Probably not.

However, there will be a time once all the dust has settled and all the sales have been made when the banks will be a screaming buy. The same way we were hesitant to short the banks too soon after writing our “War on Banks” note in 2016 so too are we hesitant to too enthusiastically grab falling knives

Accumulate, yes. Buy outright? Not yet.

But just keep an eye out for this theory coming to light more and more as it is realised that these feeders were worse for the banks than better. Now to go find my Peter Lynch book & give it another read….

All the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.