It’s a curious week in markets when two consecutive vague predictions come to fruition at once. One was CBA spinning off most of its extraneous divisions as predicted (we’ll run through this in a later issue) and the other was that the trade war sabre-rattling is slightly more serious than first hoped.

The market is taking this slightly more seriously than the last time.

Which was a little less seriously than the time before that.

Which was the first time and that time it was taken very seriously.

So this is where we’re at. Sometimes it’s about the actual fallout from certain actions, sometimes it’s about predicting the reaction to the actions. Sometimes it’s about the reaction to the reaction to the reaction.

Once it drifts into the latter range it’s time to step aside and stop listening to the noise.

Or, if you’re that way inclined, listen to the noise and take some protective measures. Alert or alarmed or both. Pick a camp.

Before I get to my thesis on Emerging Markets there is this which is old but an amazing bow to tie around the year.

Common based returns of Fangs vs the world since Dec 2017

First some credits. The extraordinary John Authers wrote a note recently for the FT about the FANGs (or the FAAMGs or the FAAMNNGs if you include them all)*

“Fangs for the memories”

It’s paywalled so apologies but the quote below is the interesting takeaway. Note this is as at the 22nd June which isn’t that long ago so still very relevant:

“The market cap of the entire S&P 500 Consumer Discretionary index has gained $318bn so far this year, of which Amazon and Netflix on their own account for $375bn. Strip out these gains and the rest of the index has dropped $57bn in market cap for the year. Thus removing just the two Fangs converts a 13.3 per cent gain for the year (very slightly better than the information technology sector) into a 1.9 per cent loss.”

*Note that Fangs in this case are now Facebook, Amazon, Apple, Microsoft, Netflix, Nvidia and Google. It gets longer every time I look at it.

So there you have it. Two stocks doing all the heavy lifting in terms of capitalisation. There’s a warning signal there somewhere if you squint really hard.

This might not help…thanks to Callum Thomas for the excellent charts he tweets.

Emerging Markets

Going back to some things I said on the radio recently regarding Trump’s trade war and I’m inclined to be in the “Alarmed” camp. The “worst case scenario” highlighted was the chance China’s yuan would be devalued. I commented that it would be a move as bold as possible and would be like “sacrificing 800 soldiers to kill 1000 of the enemy” (I nicked the phrase from a Citi analyst because it’s brilliant and fitting)

The recording is here of the interview where I try really hard to have a foot in each camp as Trump’s fresh tariffs literally just dropped minutes before!!

My part on Chinese currency devaluation is at the 4.14 minute mark.

Please indulge me while I present a bear case for emerging markets. Something I’ve been cooking up for a month but to which we have enough confirmation to commit.

Drum Roll Please…

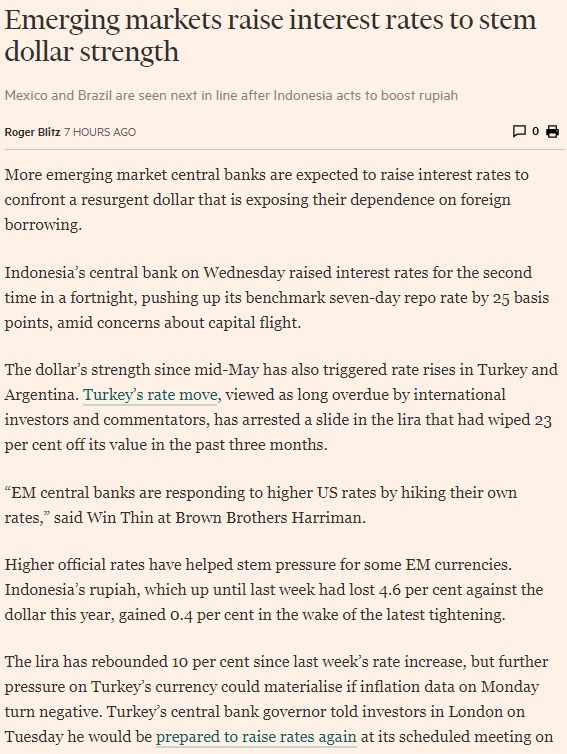

Exhibit A: Rates going up in EM countries to keep up with rate rises in the US and minimise the damage a strengthening USD has on their economies. In doing so, my theory goes, the raising of their own rates locally is a detriment to their own economies.

Read that again. It’s a lose/lose situation for EM. Read the below to make it clear.

Article from May 31st when I first started concocting this idea.

Exhibit B: The “worst case scenario” of a devalued Chinese Yuan has ramifications for the rest of the EM economy. Cast your minds back to 2015 and the calamity that occurred then when China devalued their currency in the face of declining exports. EM nations copped it the worst because suddenly their exports become less competitive. Generally speaking a trade war and the following economic contraction globally hurts the end of the chain the most.

This from a CNBC article at the time:

“What the depreciation says about China’s growth concerns should be a worry for emerging markets that export heavily to China, particularly commodity producers such as Brazil, Russia, South Africa, Indonesia, and Malaysia. A weaker yuan is also a concern for developing nations that compete with China in exporting similar goods and services to similar destinations. Taiwan and South Korea face some of the greatest risks, but Thailand and the Philippines may also be affected and even Mexico may feel the effects.”

Source here

EM 2015-16. Put very simply, Chinese Yuan comes off = bad for EM (more or less) Courtesy Interactive Brokers

So is the Yuan appreciating?

Yes…yes it is. At the fastest pace since the above mentioned 2015. Courtesy Bloomberg

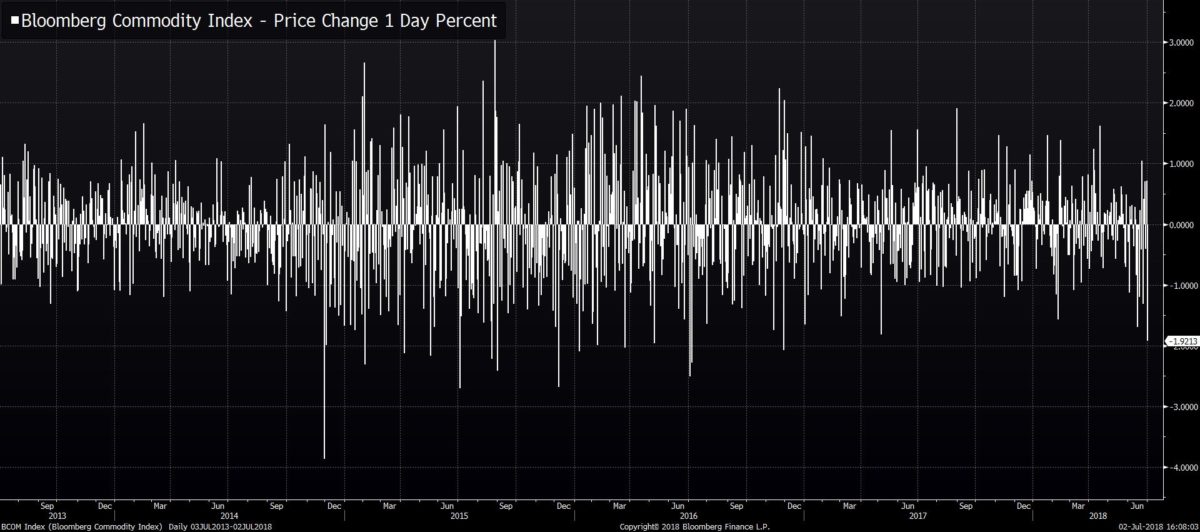

Exhibit C: USD strength is hurting commodities. We’ve been long and strong the USD for a while now and committing to it until it stops working. USD weakness helps commodity prices and all things being equal this usually helps the countries at the end of the chain. You get continuing USD strength along with tremors on a trade war, a shaky confidence in the global economy and global growth already looking a little toppy and you get results like this…

Last night was the worst night for the Bloomberg Commodity Index since late 2016. Courtesy Bloomberg & @TheStalwart for posting this one

There’s a warning sign in weakening commodity prices.

Finally Exhibit D and this one comes back to the credit cycle. Credit ends all bull markets. It is the fibre that holds the whole thing together. EM is the first sign of the credit cycle turning globally. Listen to the below, EM downturn is “more than a canary in the coalmine…it accounts for 60% of world GDP” as mentioned by Chief Economist & Head of Economic Research at MUFG’s Brendan Brown. It’s worth a listen. EM downturn is the start of the credit cycle downturn.

EM was most of the ride up on credit, it’s now signalling the start of the downturn.

Click here to listen

We finally initiated a short in Emerging Markets and, provided it continues to work, will continue to hold it. Because of the relentless enthusiasm for buying the US market we choose not to place our short there. The S&P 500 will still probably go up when the bombs finally drop. We prefer this safer shorting chance.

All the best & stay safe out there,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.