“The year 1916 was cursed; 1917 will surely be better”

Apparently this was a quote from Tsar Nicholas II’s diary. Whilst there is some debate as to the origin and authenticity of the quote I’m happy to use it here regardless. Please keep it, Brexit & Trump in mind while you read on as we present to you VFS Group Investment Committee’s “French Scenarios.” (Enjoy)

Polls close 4.00am Sydney time Monday morning. FX Markets open at 6am Sydney time & US futures open at 8.00am. The ASX opens at 10.00am on thin volume due to it being the Monday ending school holidays before a National day of remembrance on Tuesday. Should be an interesting Monday morning.

We couldn’t find a photo of Macron & Le Pen together so here’s the next best thing…

First scenario:

- Macron (Centrist) has a strong showing beating Le Pen (far right) or equaling her tally. Similarly, Macron performs as expected but Le Pen doesn’t do as well. This would have the same impact in terms of market.

Market impact:

- French bonds rally (yields down). Periphery bonds (Italy in particular) also rally. German Bunds come off.

- Broad “risk on” environment. Gold goes down as does the VIX. European equities up. Particularly French banks. In this environment, We’d want to take bank exposure where we can. Although it would be painful having exited an existing long banks position we’d know it was better to be on the sidelines and come back in for the rally.

- Australian equities would benefit although we don’t think there would be a ‘huge’ rally. Or at least if there is it will be to do with domestic issues not because of European issues.

- EUR rallies. Probably quite significantly.

Second scenario…we will say this only once…

Second scenario:

- Macron performs poorly and Le Pen outperforms suggesting a strong ‘shy’ Le Pen vote. This is a fairly neutral outcome but we’d expect equities to slide lower. This is possibly the worst outcome from a trading perspective as it would mean heightened uncertainty and jittery markets until the second round two weeks later. Annoyingly it is also probably the most likely outcome.

Market impact:

- We’d expect French yields to remain elevated. This would be a tricky environment in which to operate.

- European equities would probably oscillate in a fairly wide range. Moving on every single poll from now until the second round.

- Australian equities would be largely unaffected.

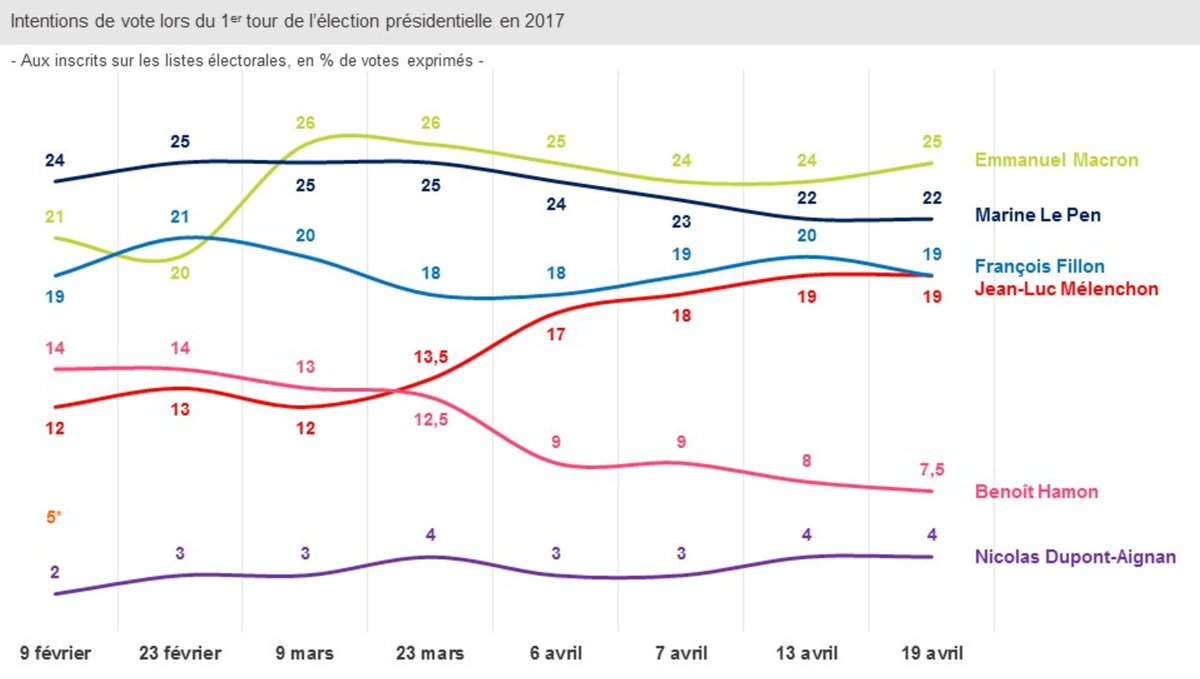

I ran out of ‘Allo ‘Allo! pictures so here’s something more meaningful. Latest Rd 1 polling as at publication… Courtesy: @harrisint_fr

Third scenario:

- Macron performs very poorly and/or Melenchon (Communist) outperforms leading to a second round of Melenchon vs Le Pen.

Market impact:

- This is the Armageddon scenario. Global risk off. We’d imagine US futures would open around 5% down.

- Australian equities get absolutely hammered. With a thin trading day this could lead to a meltdown in Australia if US futures really start coming off.

- From a trading perspective there will be enormous opportunities. The kind that only really come around once a year. (If even that)

- We expect the market will at some point attempt to do what it did post Brexit and Trump and rally but that rally won’t last. This scenario could very easily lead to a dissolution of the EU. The markets would at least start discounting that possibility which as far as we’re concerned would have the same impact.

- On the short side take your pick. Some of the yield type stuff might get a bid as the only place to park money but otherwise this is a real risk off environment.

- EUR would crash. A EUR short against the YEN would be the best way of playing this.

- French bond and periphery bonds crash.

- European equities down anywhere up to 10% at an index level. Banks would probably be off 15% on the day and going down more over the next week.

This is the French Amazon. You can order the whole box set of ‘Allo ‘Allo! here. Not sure why, though…

Final Thoughts:

Not going to predict the exact outcome here. If pressed we would say Scenario 2 but there’s no conviction in that. The real problem is Melenchon, the communist, is surging. We also do not have a lot of faith in Macron. He looks flakey. The party machine lacks substance. We also think he’s making errors in the final week.

From a portfolio perspective I don’t want to take any long exposure into this. It really is picking up pennies in front of a freight train. You could get a positive Macron scenario which leads to markets rallying but there will be plenty of time to trade that after the event. And if you get caught long and the doomsday scenario happens it’s going to be ugly. We do have a huge advantage having low volume here on the semi-holiday Monday.

Most of the usual players will be out of office and markets will not be as efficient as possible.

We will be in and ready, however. Please call any time to discuss.

All the best,

James Whelan,

Investment Manager

VFS Group Investment Committee

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.