If you haven’t already, please check out our latest contribution to Business Insider’s ‘Devils & Details,’ the most popular business podcast in Australia. We cover OPEC, the RBA & the ongoing commodities rally. At the end I also tip the Swans and the Storm so I’m due a few wins this week I’d say.

There’s been plenty going on this week that’s caught my attention. Unfortunately just the facts today for some obvious reasons.

Firstly, and I think most importantly, this appeared on my timeline over the long weekend…

Trouble brewing…

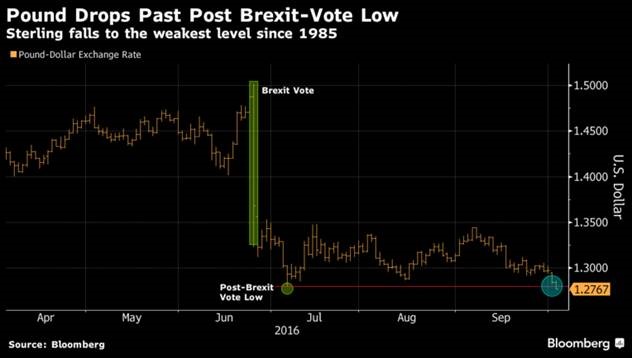

So remember that world-ending event Brexit that actually began an all-asset global rally because it was going to be postponed indefinitely?

It just came back…

Can’t be that bad..

Let’s go back to Brexit date to see where we stand now vs that dark day in our lives at the end of June…

So everything that was put off until later is now very much back on the cards. Financial services will get no special favours, according to British PM May. They’re being left out in the cold in exchange for self-determination on issues like immigration. The plan is to have Article 50 triggered by March next year.

Expect exporters to do well on a cheap currency and the same property panic as companies have to move forward their plans to shift out of London.

We’ll keep you posted but it’s time to dust off your Brexit Disaster Guides and open to Chapter 6- ‘Post-Procrastination.’

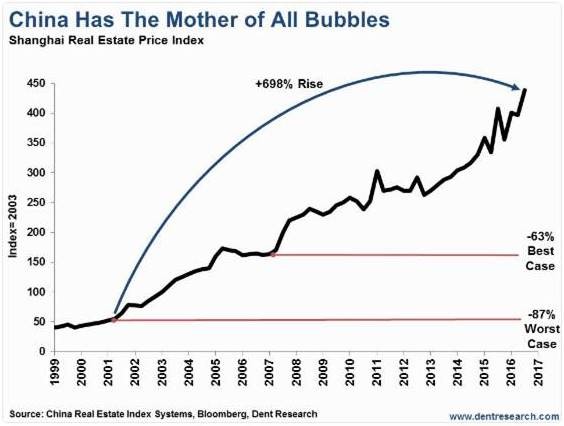

Speaking of property panic, here’s China’s situation…

A few weeks ago I mentioned that China was potentially moving into ‘Basket Case’ territory. On the 29th September this dropped on CNN:

http://money.cnn.com/2016/09/28/investing/china-wang-jianlin-real-estate-bubble/index.html

Spoiler Alert: It’s Chinese Real Estate Billionaire Wang Jianlin calling the Chinese property market the biggest bubble in history.

Ok, maybe he’s talking up his own book in a move to entertainment but here’s an equally scary chart to go with it…

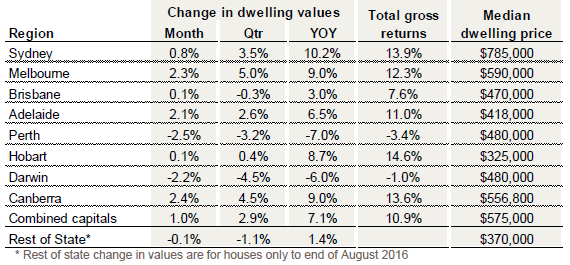

Glad that’s not happening here…

Courtesy CoreLogic.

Here is the article and further research shows Perth dwelling values are back to where they were in 2007 which is devastating but not unexpected. (Thanks @PeteWargent for that stat).

You don’t need to be a genius to figure out what happens next as more houses are sold at a loss.

Happier news, finally….

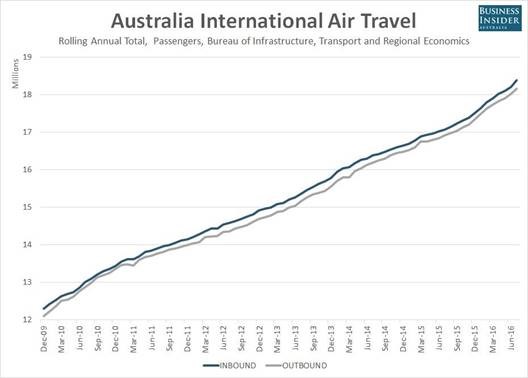

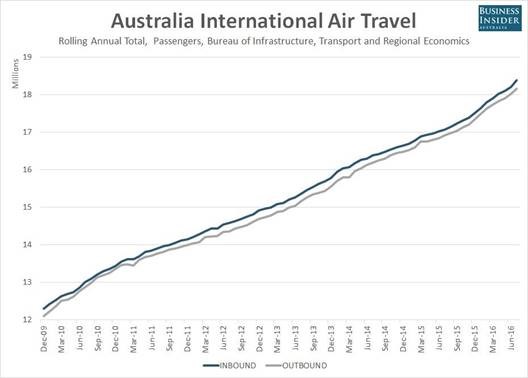

We’re still riding the wave of ever increasing tourism. Here’s a link to the article by our good friends at Business Insider but again the key takeaway is the 31.4% increase in passenger traffic to and from China.

http://www.businessinsider.com.au/chart-international-air-travel-in-australia-is-soaring-2016-10

I continue to push my emphasis on owning at least one good tourism-leveraged stock in all portfolios.

Even happier news…

A whole article and this is the only mention of Trump!

Stay safe & all the best,

James

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.