Business Insider: My dire April prediction for Australia

With reports of a third aircraft carrier heading to the Korean Peninsula maybe it’s time for a little levity. I stress that, although significant, the risk of nuclear war isn’t the most immediate risk to local equities markets at this current point in time.

We got bigger problems… Courtesy Pete Wargent of AllenWargent property buyers who simply Googled “property” & “perfect storm” together.

I was listening back over some things that had been said recently to find some direction for the months ahead. I came across an old Business Insider podcast from April 7th which I link above. Just after the 20 minute mark I mumbled this,

“I think that what Australia has done has simply postponed what the US has only just been able to pull itself out of.”

We saw no reason to be long the big banks in May and following the Budget preferred the regional banks.

Shortly after we made the switch, the good people at S&P railroaded us and downgraded Australian banking across the board which hit regionals the hardest. Swift exits were needed & we see no reason to be in Aussie banking at all for now, but that is all later on below.

I have been generally uninspired to write lately, searching for something of real substance to spark my enthusiasm to hammer the keyboard and finally something has appeared which is worthy of column space: sandwiches.

(Don’t worry, it leads to a concerning list of reasons to NOT buy this market so just go ahead & skip to that)

“Sandwich Hack”

Recently the BBC ran a “life-hack” (that’s millennial-speak for “way to make life easier somehow”) in honour of Britain’s Sandwich Week. Note this isn’t some clickbait website running out of some kid’s basement, this is the BBC. It seems this chap, business reporter Dougal Shaw, “discovered” a way to save a fortune on lunches, simply by making his own. Armed with this breakthrough, Mr Shaw created a video documenting how we all may benefit from his pioneering ways. Link here for those who don’t believe me.

“The idea suddenly came to me when I went to buy my usual lunch on my work break”

But where would one find the requisite ingredients for such a task?

Don’t worry, turns out supermarkets have everything you need…

Relax, I haven’t completely lost it and I can assure you there is a point to this so I’ll spare you further details on this groundbreaking improvement to our lives with one last shot, surely proving this is no hoax. Mr Shaw posted photos of his handiwork which clearly shows the work of a man who’s never cut bread in anger.

No sandwich deserves this fate…

Now, on with the show…

Bringing this back to markets (and call this a bold leap) but I think the writing is very much on the wall that this generation will be the worst equipped generation in history to deal with a recession. And I believe we are well & truly due.

Recession? What Recession?

Obviously this example above is in the UK but the point still resonates that conditions here are less than expansionary:

1. Oil is being held up (just) by dubious production cuts and not on demand;

2. Iron ore is continuing to fall with Chinese stockpiles continuing to rise to record highs. I won’t even go into China tightening its liquidity but that’s the biggest issue out there that no one is talking about;

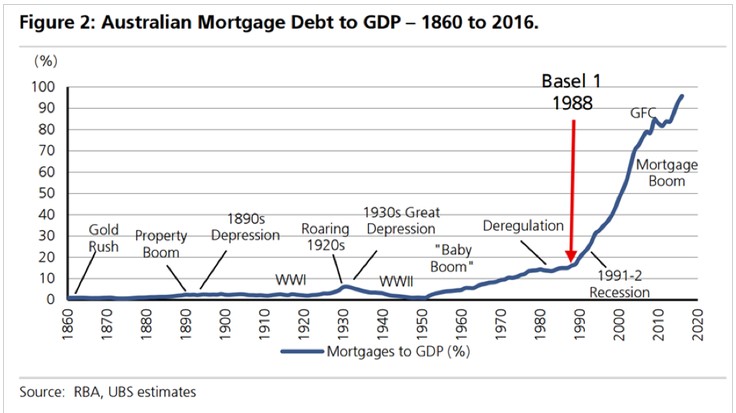

3. Our housing market looks extremely shaky, not necessarily in the market itself but in the regulation of it, with more serious chatter coming through the wires about Investor Loans being restricted, further cooling a tenuous property market. Debt-to-income ratios have well and truly blown out.

4. Where are the jobs? Where is the growth? Even if Amazon wasn’t setting up shop here our retail sector would still be in real trouble with consumer spending already weak;

5. Wage growth is stuck at record lows while our personal debt is as high as ever;

6. Regardless of the RBA, banks will have no issue passing on rate hikes incurred overseas or via Government taxation. We don’t see “real rates” going backwards any time soon.

All we can urge right now is extreme caution. This is one of those times when the market is actually a representative of economic conditions and the conditions are not good. Furthermore it’s hitting the market where it hurts the most, the big banks, which are held by pretty much every fund in the country. It’s a “damned if you do, damned if you don’t” moment as investors get squeezed on their home loans, their investment loans or both while the value of their super fund declines every day.

We’re going to have to make our own sandwiches for a while…

I can’t put it in clearer terms than the image above, sent by old friend Jonathan Pain of the Pain Report just this weekend gone. Please be careful out there. We have strategies in place already and will be adding to them to take advantage of this weakness, none involve buying the Australian banks here.

My advice is that we get used to making our own sandwiches as the belt-tightening continues across the land.

If you or anyone you know would like to know more about the themes contained or how to benefit from the strategies of the GMF please do not hesitate to contact us directly.

All the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

+1300 220 360 | gmf@vfsgroup.com.au | www.vfsgroup.com.au

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.