The Fed will hike in December. I don’t know a sensible person who isn’t now of that view. We were given a warning early last month of what would happen if they were hiked out of the blue and now, a month and a half later, we are now adequately conditioned for what is now a world at the bottom of the rate cycle. This being said, I’ll dust off some old notes (from September 20th) that are now the serious game plan for the rest of the year.

“Here’s the plan as it stands, again IF we’re at the bottom of the rates cycle in the US:

- Fed raises rates either with or without the stars aligning for economic growth- they’re at the bottom of their cycle

- USD rises, AUD falls

- AUD falls- the only reason for the RBA to cut is now removed. We’re at the bottom of our cycle

- Sentiment continues to shift out of the “bond proxies” (utilities, telcos)

- Aussie stocks reporting in USD do well

- Stocks benefiting from rising yields do well

- Stocks that have too much debt or have used cheap money for buy backs will do badly

- Banks everywhereshould do well. Aussie banks are still leveraged to a really dubious residential market so I’d still be a little hesitant

- China is apparently borderline basket-case with their credit to GDP gap is now at a dangerously high 30.1 –read this and panic

- Australia (despite the above on China) should get bought well once our dollar comes off by foreign funds capitalising on the relative cheapness this would bring”

And there you go, friends. It doesn’t get any simpler than that. There is a rotation underway from one type of stock to another.

Some of these stocks are ones we have all been conditioned to loathe, but that’s what happens in a sector rotation. We’ve been recommending perennial dog QBE for almost two weeks now and that’s a company I’m fairly certain I’ve sworn at least twice in my life never to own.

Things change and change is good. Reassessment of your portfolio is a great practice to get into. If you haven’t yet, take the time to look at what you’re holding and compare it to the above playbook to see if it cuts mustard.

Note point 9 is still relevant and you can replace the article linked there with any one of the number of articles being generated every day on just how bad China’s debt-fuelled bubbles are.

With that behind us it’s time for the news….

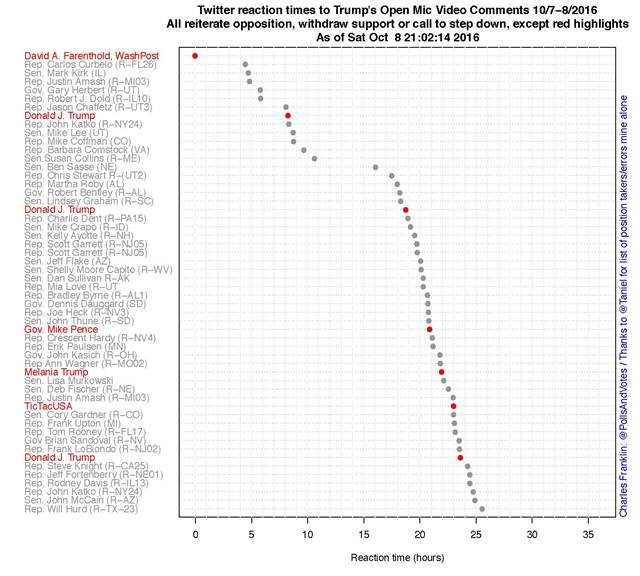

Trump is dead in the water. He will not win the Presidency. My political mind cannot figure out a way in which Secretary Clinton does not win the most valuable states and the election will be called before the finish of dinner in New York. As all would know I’m a huge fan of Twitter for news and it amazed me just how quickly Trump’s allies were to discard him after the revelations of the weekend. Here it is in a simple chart showing the speed at which Republicans disavowed their nominee:

Please note that all of this is pending the next major drama because if we’ve learnt anything so far it’s that this election can turn on its head in an instant. As a former political insider I can tell you a week used to be a long time in politics. Now it’s an eon.

What this means for markets? Risk-on. The adage “markets hate uncertainty” still holds true so a clear winner from either camp is being seen as a sign of stability.

Chart of the week…

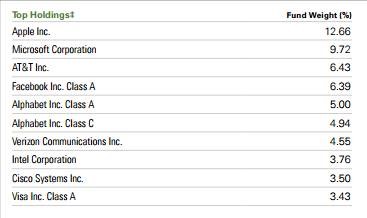

We’ve had our eye on tech stocks for a while and clients hold Amazon and Facebook at the moment (quite happily too). Specifically this chart was put out by See It Market (@seeitmarket) on Monday and looks fairly straightforward:

This is a simple break upwards for the State Street Tech Sector ETF listed in the US. Here’s what its top holdings are:

So, provided simple technical analysis can be trusted, everything seems to be doing what it’s supposed to.

Oil…It’s been a while…

Anyone reading the news would have seen that there’s been substantial talk of a production deal to help raise the per-barrel price of oil. Whilst this is great news, since the world requires oil above $50 for inflation to become a thing again, I ask that it be treated with extreme caution.

We’ve seen this movie before. Oil cartel threatens production cuts, oil rises, US shale becomes viable again, oil declines, cartel threatens production cut again, oil rises, production cut talks fade, oil declines.

And finally something a little odd…

In the rising rate environment outlined above we’ve seen bonds get sold off in anticipation for a cheaper buy later (really simply, rising government yields in the future mean why hold this low yield bond now when you can get a higher yield one in a few months.) However, reading the Financial Times over the weekend I saw global bond funds attracted $11.4bn of fresh capital last week, the second highest inflow of the year. Reasons indicated were a protection from the volatility of the US elections. In a one-horse race which the election now seems it now stands that some of that flight to safety will have to find its way back to riskier assets.

Stay safe and all the best,

James

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.