Firstly, and as an apology, this note will be a prelude to something more substantial regarding what a Trump victory means for the USA and the planet. Whilst it’s not world ending, the world’s eyes are currently upon a very small handful of people and so we must assess its relevance and impact. For the dismissive amongst you I ask that you please remember the Brexit vote which impacted our markets severely on Friday 24th June. Whilst I predicted a vote for status quo by the British public, I never discounted the possibility that there is an ever growing disconnect between how people say they will vote and how they actually vote. I’m happy to engage anyone on the reasons behind the recent rise of this phenomenon, here is a link to the Wikipedia site regarding the ‘Bradley Effect’.

Put simply, people feel obligated to tell pollsters they are voting a certain way for reasons of political correctness but when in the privacy of their own voting booth will vote their true minds. We saw this in Brexit, we may well see it in the US Presidential Election. Make no mistake, we are monitoring the chatter and after a year of the unexpected becoming reality we’re aware of the possibility that in 2016 ANYTHING is possible. Trump’s performance today is a good warning not to write anything off.

Watch this space…

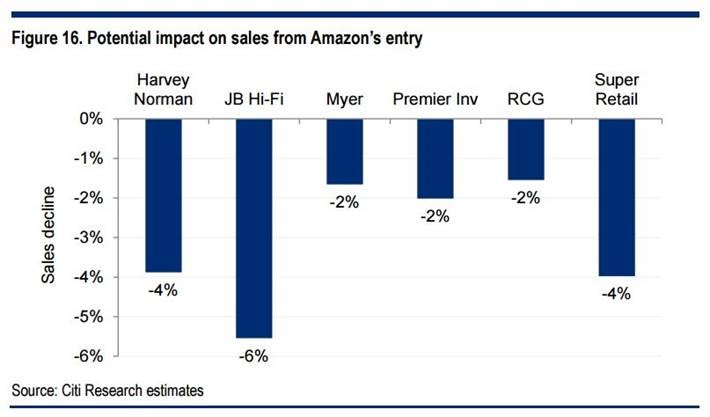

Regarding last week’s note there was a warning I made regarding the impending havoc Amazon will inevitably wreak upon our retail markets. Last week I wrote this:

“Amazon is one of my preferred US stocks and credit to our Hedge Fund correspondent David Pain for opening my eyes to the reasons why. Do your own homework on Amazon but I won’t be anywhere near the supermarket stocks when this news drops.”

Yesterday this was in the SMH Business Day regarding a Citi research report putting some impact numbers around what happens when a competent player enters the Australian scene.

Here’s the summary:

I reiterate my warning that you do not want to be left holding these stocks when Amazon launches this here. They are very good at what they do.

Regarding the day to day market, two key themes I’ll stress for the near term have been raised by well-read commentators The Coppo Report and Market Matters.

In summary:

- There is around $7.5 billion worth of Australian dividends hitting accounts this week,

- $4.5 billion in dividends were paid last week,

- $4.8 billion will be paid next week,

- There is not a great deal of volume going through the market at the moment,

- This money HAS to find its way somewhere.

I’m happy to see this market get bought based on this simple annual phenomenon. I’ll stress the importance of the need to be aware that the tanker is turning with regards to global interest rates. We were given a warning a few weeks ago when it was suggested the Fed may start raising rates without the perfect scenario supporting them. Whilst that may be postponed for the time being it is still something worth considering in your investments.

For now, for better or worse, the world has its attention on the US Elections and whether it is as important as some say is irrelevant because if the market cares, so to must we.

All the best,

James

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.