Firstly to the banks, which have been receiving just the right amount of attention based on this time of year.

A few notables:

CBA’s legal beagles were keeping a close eye on the Tabcorp’s recent trial on AML/CTF breaches specifically because

a) They need an idea of how much to allow for in fines and b) to see if the cases would be heard one at a time or grouped all together.

Fortunately for CBA it looks like a win for the bookie means a win for the bank. The Federal Court ruled that all of Tabcorp’s breaches over a period of time could be treated as one. One hearing is better than 53,000 separate hearings.

Tabcorp were also fined the relatively insignificant amount of $45m. As a guide, $45 million is a little less than half of the settlement ANZ & NAB have agreed to pay for rigging the BBSW rate for two years. CBA’s upcoming fine will be more, I can assure you. However it’s still good news for CBA who are probably adding a line item to their next update to include “Slaps on the Wrist Allowance”.

But then there’s this…

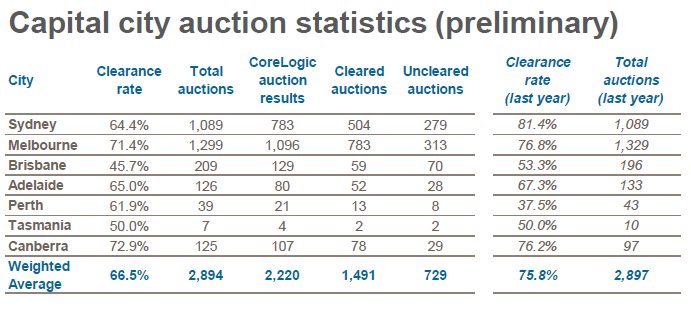

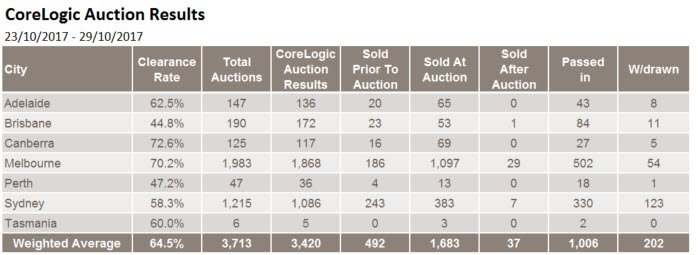

Secondly re the banks are clearance rates and a continuation of the theme I’m running with now that property is slowly cooling on bank macro prudential limit changes. Growth isn’t a thing they have on the horizon at the moment. I still believe eventually banks will have to dip deep into their beloved margins to gain share of a thinning buy-side crowd and that will affect (possibly) dividends and (probably) share prices. But anyway here are the latest rates:

Courtesy Business Insider

And, just because I can, here is the weekend previous to start November. First time since 2015 Sydney rates have begun with a ‘5’.

Be alert but not alarmed….

Batteries…when the tide goes out make sure you have a chair

The lithium/graphite/cobalt/nickel revolution continues to rage on & we’ve seen some phenomenal returns on a range of stocks across all sizes. I have a short list of favourites (available on request) which are performing admirably in a very short space of time and I still think the space has further to go. However as always ups come with downs and eventually the day of reckoning will come when only the best companies in the space will survive. I’m reminded of the uranium & iron ore booms pre-GFC: Make sure the companies you’re investing in actually have what they say they do, lots of it, that it’s of a decent quality & that it’s relatively easy to pull out of the ground.

We’re still a way off that day but it’s not until the music stops that we’ll discover who’s swimming naked.

Of interest is an IPO coming up called New Energy Solar and whilst this isn’t a recommendation it may be of interest to some looking for an investment in renewables. I’ve seen the company and should be able to help with any questions.

Details are here and for more information please drop me a line. PDS contained here.

Meanwhile…

Last two things I promise…

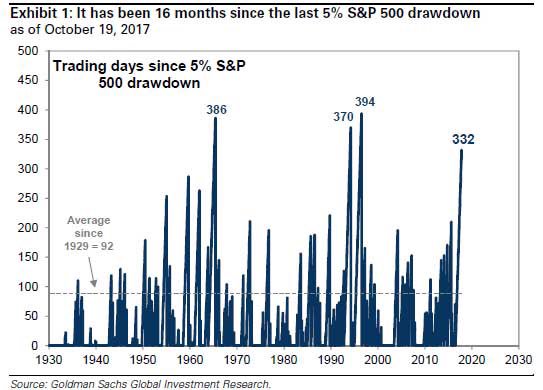

1. This chart above is important. Averages exist for a reason. The US S&P 500 index has gone 332 days since a 5% pullback & the average is 92 days. That’s up there with some of the all-times of all-time.

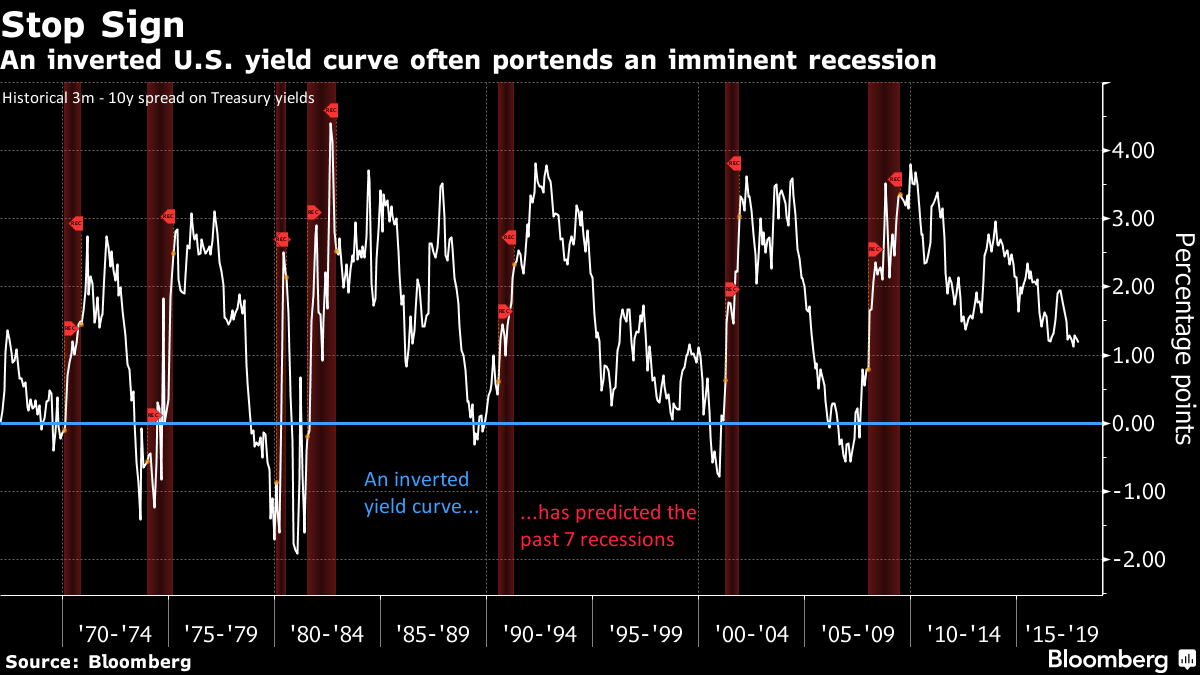

2. We’ve been moving to the sidelines in the US recently and our last exit was from the US banks pocketing a healthy return for the Fund & keeping proceeds in USD. It’s all about the yield curve which was our main reason for entry but since the story has now changed, so too must we. Flattest curve in a decade and whilst the reasons are numerous and debatable, I don’t want to be sitting here saying I saw the warning signs and did nothing about them.

I’m not calling a correction. I’m not calling a recession. All I know is that I was always taught to listen to the bond market when it’s trying to tell you something and this seems like a yell instead of a whisper.

Read this from Bloomberg and look at the chart below. It’s important.

Or is this “the new normal?”

Stay safe & all the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.