- Market Wrap

- Growth Portfolio Returns

- Defensive Portfolio Strategy

- What the market think will happen in 2016

For the past 5 months we have seen the local market trade between 5300 and 4900 and January was no different. With the market finishing the year at 5300 on the back of the much anticipated Christmas rally we saw a heavy sell off over the first 2 weeks of the year which saw us hit new lows. To say it was savage would be an underestimate and we have started the year with the same panic that engulfed the market for the majority of last year.

The under-performing sectors were energy and materials but no sector finished the month ahead in an ominous sigh for the year.

A number of markets around the world have entered bear market territory which is defined as a fall of 20% from the highs. China is the main player here and the effects of having an inefficient equity market is starting to show its strain. It is not uncommon to see falls of over 5% on a daily basis and there were a number of days in January where the market actually didn’t trade because of in built mechanisms to reduce volatility.

Our growth portfolio only opened a few positions. In late December we took our final profit on A2 milk at $2.15 and we re-entered into this at $1.55 on a pullback. Our view remains bullish on this stock. We were stopped out of our long positions on ALL and TTS

We made some small money on an Iluka Short and continue to hold Scentre Group (SCG)

Growth Portfolio Return

Defensive Portfolio

What the Market thinks will happen in 2016

In a recent poll done by CitiGroup which surveyed from more than 70 institutional investors we see a far more subdued market entering the New Year. Below we highlight some of the key findings

Rates Are Headed Higher Plus Implications

The vast majority of investors think the Fed will be raising rates again in either 1Q16 or 2Q16 (see Figure below) and that bond yields are headed higher too (found in Figure below). As a result, investors do not

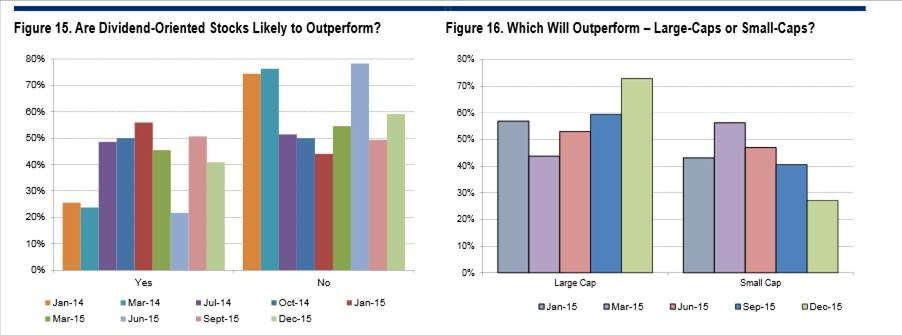

particularly like dividend yielding stocks anymore (shown in Figure 15) and seem to be warming up to large caps (seen in Figure 16), which arguably have stronger balance sheets.

Intriguingly, they also seem to have a bias towards value over growth based on client responses.

Almost 40% of investors project that the S&P 500 will close 2016 between 2,100 and 2,200 (with a weighted average of 2,137), below sell-side consensus of about 2,200; nearly 35% believe the market will end the year below 2,100. At this time last year, the buy-side weighted average expectation for the S&P 500 in a year’s time was 2,177. Plus, 55% think there’s a higher probability of a 20% downward move in stock prices than a 20% rally.

For more information please don’t hesitate to contact our investment team on 1300 220 360.

VFS Group