A lot of queries have been coming in over the last few weeks about the performance of the defensive portfolio. The investment mandate of the VFS defensive portfolio is to outperform when the markets are moving lower by protecting the asset but to also to provide long term returns to the investors through conservative growth and income.

This is exactly what the VFS Defensive Portfolio has done during the recent selloff in equity markets. To illustrate this point we have provided some charts showing corresponding performance during the correction. What is astounding is that most of our investments are focused on banks and other high yielding stocks where most of the losses were felt by investors and as a result these investors have exited the market and given up any long terms gains that can be made.

Defensive Portfolio VS ASX 300

Clear out performance against the index and it has been this way for quite some time. Our investors are fully protected at current levels and any further weakness will see a great divergence between the chart in favour of the VFS defensive portfolio. We have beaten the index over every time frame, importantly only falling 1.39% over the last month.

Defensive Portfolio vs Financial Index

With financials being the main driver in equity market over the past 2 years we thought it was only fair to gauge how the portfolio has performed in comparison. We acknowledge that we have been behind since February of this year but the recent pullback has illustrated how we have structured our investments perfectly to provide steady returns without the risk involved in a buy and hold strategy. So the banks have been on a bull run and we are still beating them!! If there is further weakness in the financial sector I do not anticipate significant fall for the defensive portfolio.

So what are we doing now?

Right now we have a number of opportunities that provide an exceptional payoff for our clients. Below is an opportunity in CBA

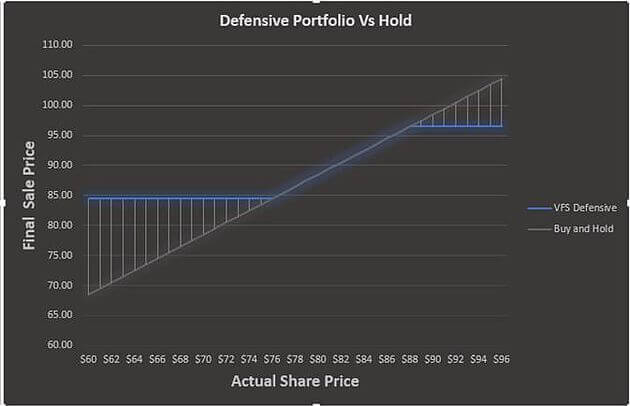

The chart below provide a quick snapshot as to returns you can expect. What you can clearly see if that after dividends are taken into consideration (until august 2016) we have a worst case scenario of $85.00 returned to the investor over the next 16 months – given that the current share price today is 84.00 that is a result we would be happy with. You can see how we don’t actually participate in any downside in the market unlike the simple buy and hold strategy which can suffer significant losses.

Obviously we do lose on some upside in the market but at that point we would still be locking in a return of close to 18% for the term of the investment. Forn a defensive portfolio there is still a lot of growth to be had.

We stress that for investors who have high cash balances this strategy provides and exceptional opportunity in a conservative strategy.

For more information or a free consultation on this strategy, speak to one of our Portfolio Managers on 1300 220 360.