Afternoon All,

There is little doubt that there’s more than the usual amount of panic around at the moment. One of the best momentum traders I know has finally waited to see the whites of their eyes and has called the US S&P 500 short, and he’s done it publicly.

That’s big in my view, particularly when added to this from NorthmanTrader last week which I drew attention to in my last note. I put it here again because I can’t stress its importance enough.

https://northmantrader.com/2016/05/07/the-golden-key/

Gauging Sentiment

I received some commentaries over the weekend and none were overly positive (as you can tell). One contained a beautiful few lines which, in my view, is the most concise summary of the rock we currently find ourselves clinging to. I’m withholding his name because it wasn’t an external communication but I thank him for the words.

“7 years of zero rates has led to poor investment everywhere. Businesses have not used the cash to spend on increasing productivity (or sales) they have used zero rates to financially engineer their stock prices through buybacks.”

- Just poetry

So how bad are things at the moment?

I’ll steer clear of China’s disastrous debt issue and take a peek behind the curtain at the US. Now please take this with a little salt but this appeared in Wolfstreet.com by Wolf Richter regarding Freight Rail Traffic (one of the better leading indicators for economic activity in the world’s largest economy).

“Total US rail traffic in April plunged 11.8% from a year ago, the Association of American Railroads reported today. Carloads of bulk commodities such as coal, oil, grains, and chemicals plummeted 16.1% to 944,339 units.”

- Published May 4th

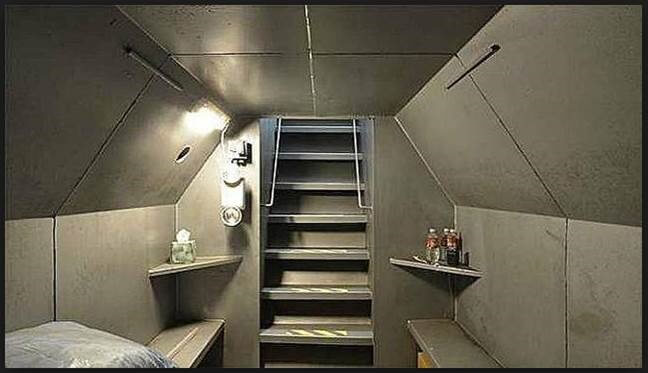

There’s corners of the internet where perennial market crash callers walk hand in hand with doomsday preppers and this is almost one of those examples. What was interesting was the section of photos regarding the storage of redundant locomotives. Have a look.

Source: http://bit.ly/1sgs985

I don’t enjoy giving specific recommendations on this note so all I’ll say is that there is a way to short the US market from Australia (either currency hedged or unhedged). If a client was to ask me to do this for them, I wouldn’t hesitate.

Redemptions back up to 2011 speeds

The papers didn’t help with the Weekend FT running a front page story regarding redeemptions from stock funds hitting USD 90bn this year, $7.4bn coming just in the last week. US jobs growth was called “disheartening”. So it would seem that investors are rushing to the sidelines at the fastest rate since 2011. Much of this is moving money away from a well-rallied market after the correction at the start of the year. The rest is possibly up to the exhaustion felt by markets rallying just through cheap money having to find a home as opposed to economic growth. Beware.

Oil and Silver and a diversification idea

NAB & Mac Bank go ex-div on Tuesday and it’s looking like it could be a good week for oil due to supply disruptions in Nigeria, Venezuela and Canada. If given the choice to be on the bus or in front of the bus I’d rather be on the bus. That’s a temporary view as I believe oil won’t go back to the levels we’ve once known. It flows too easily and cheaply and is not in as high demand. Alternatives are cleaner, more efficient, increasingly popular and (relative to the past) cheaper. On that note the FT ran a good little article about Silver potentially growing in price on the back of the solar panel revolution. Solar demand makes up about 7% of silver demand and the solar market is growing by ~20% each year. Agree with the method of power generation or not, a trend is a trend.

So as you’re prepping your bomb shelter for the impending end of the world (see above) maybe some silver coins next to your gold bars in the safe would be good for diversification.

Good luck and all the best,

James

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.