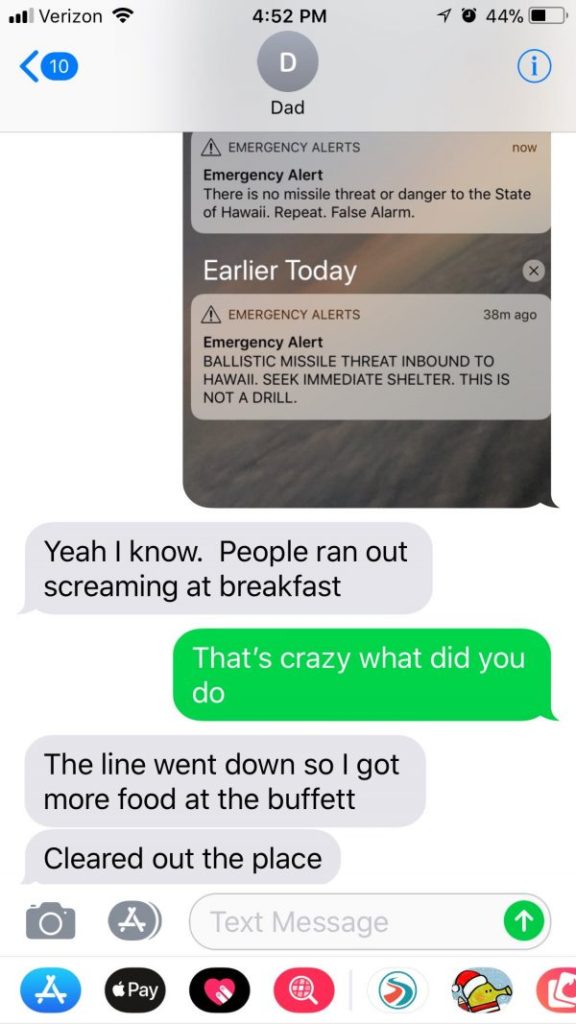

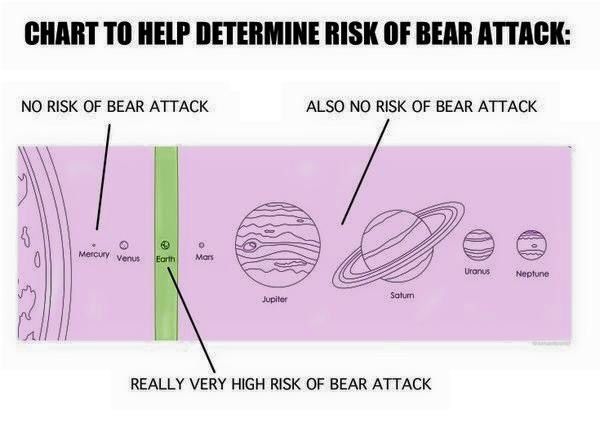

It’s a curious week in markets when two consecutive vague predictions come to fruition at once. One was CBA spinning off most of its extraneous divisions as predicted (we’ll run through this in a later issue) and the other was that the trade war sabre-rattling is slightly more serious than first hoped.

The market is taking this slightly more seriously than the last time.

Which was a little less seriously than the time before that.

Which was the first time and that time it was taken very seriously.