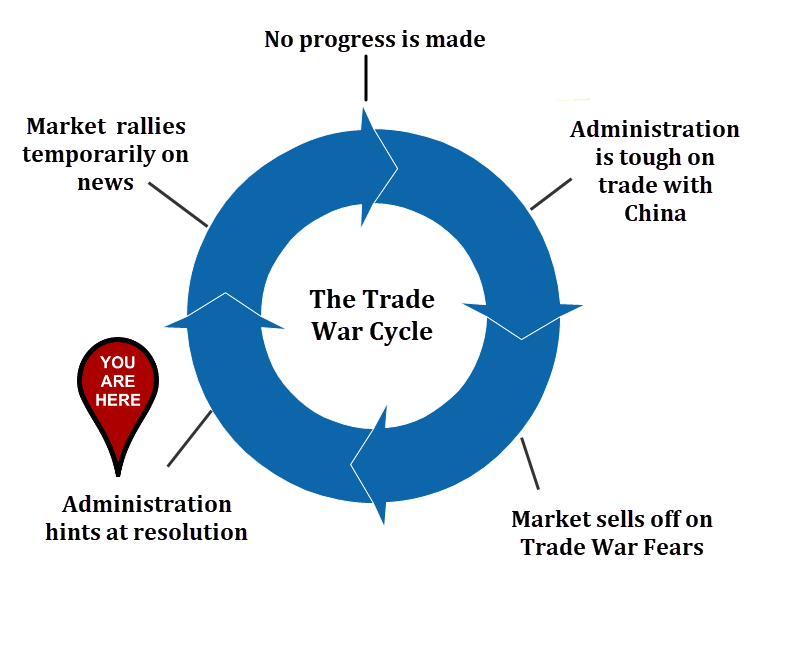

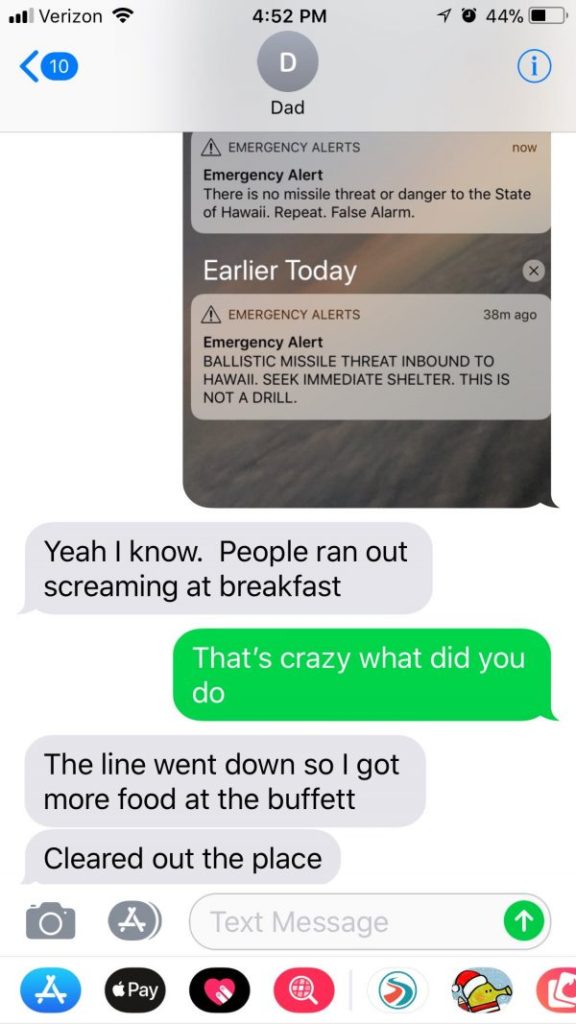

More often than not we find ourselves wondering if it’s possible to obtain financial security and retire early. Is there anything better than making money while you sleep? This concept might sound crazy, but passive income is more than a pipe dream. Passive income provides the freedom and ability to live life on your own terms.

This is where dividend-paying stocks play a big role for most ASX investors, especially when you club it with franking credits. A hidden tool that’s becoming increasingly popular in the investing world is ETFs. ETF is an Exchange Traded Fund that operates by investing in a basket of shares rather than an individual company’s stock, just like mutual funds, except that it trades like stocks. The most common of these are known as index funds, which invest across an entire stock market through an index such as the S&P/ASX200. The biggest advantages of ETF investing are portfolio diversification, risk management, lower costs, and tax benefits.

Dividend investing has proven to a profitable endeavour for many investors. According to Forbes contributor Brett Owens, dividend investors who look ahead have the potential to score annual returns of 15%, 20%, or even 25%, if only they pick the right dividend-paying stocks and stay the course.

ETFs can help you compound your wealth very effectively over your working life, especially if you can make regular and substantial contributions (especially during market dips).

Best performing shares last week:

The S&P/ASX 200 index ended the month of November with solid gains, recording a 2% gain to finish the period at 6,846 points. The three best performing stocks in the index were:

The Bravura Solutions Ltd (ASX: BVS) share price recorded a 25% gain, coming up as the best performer on the index last week. The fintech announced that it was on track to achieve its FY 2020 guidance of mid-teen net profit growth. Adding another layer of support was Goldman Sachs recommendation upgrade to a buy rating.

The Caltex Australia Limited (ASX: CTX) share price also climbed high, not lagging too far behind, with a gain of 24.1%. A driving force was its announcement of an unsolicited takeover proposal from Alimentation Couche-Tard. The Caltex board is currently considering the offer.

The Virgin Money UK PLC (ASX: VUK) share price rocketed 22.3% last week. Investors were buying the financial services brand’s shares after its trading update revealed its full year results. Adding another layer of support was Macquarie equities’ recommendation upgrade to an outperform rating.

In other words, if you had invested a $1,000,000 altogether in these companies at the start of the year, you would have made $230,631.76 in capital growth AND $26,592.26 in dividends, which is a total of $257,224.02 over the year as passive income!!

All the best,

Jack

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.

More often than not we find ourselves wondering if it’s possible to obtain financial security and retire early. Is there anything better than making money while you sleep? This concept might sound crazy, but passive income is more than a pipe dream. Passive income provides the freedom and ability to live life on your own terms.

This is where dividend-paying stocks play a big role for most ASX investors, especially when you club it with franking credits. A hidden tool that’s becoming increasingly popular in the investing world is ETFs. ETF is an Exchange Traded Fund that operates by investing in a basket of shares rather than an individual company’s stock, just like mutual funds, except that it trades like stocks. The most common of these are known as index funds, which invest across an entire stock market through an index such as the S&P/ASX200. The biggest advantages of ETF investing are portfolio diversification, risk management, lower costs, and tax benefits.

Dividend investing has proven to a profitable endeavour for many investors. According to Forbes contributor Brett Owens, dividend investors who look ahead have the potential to score annual returns of 15%, 20%, or even 25%, if only they pick the right dividend-paying stocks and stay the course.

ETFs can help you compound your wealth very effectively over your working life, especially if you can make regular and substantial contributions (especially during market dips).

Best performing shares last week:

The S&P/ASX 200 index ended the month of November with solid gains, recording a 2% gain to finish the period at 6,846 points. The three best performing stocks in the index were:

The Bravura Solutions Ltd (ASX: BVS) share price recorded a 25% gain, coming up as the best performer on the index last week. The fintech announced that it was on track to achieve its FY 2020 guidance of mid-teen net profit growth. Adding another layer of support was Goldman Sachs recommendation upgrade to a buy rating.

The Caltex Australia Limited (ASX: CTX) share price also climbed high, not lagging too far behind, with a gain of 24.1%. A driving force was its announcement of an unsolicited takeover proposal from Alimentation Couche-Tard. The Caltex board is currently considering the offer.

The Virgin Money UK PLC (ASX: VUK) share price rocketed 22.3% last week. Investors were buying the financial services brand’s shares after its trading update revealed its full year results. Adding another layer of support was Macquarie equities’ recommendation upgrade to an outperform rating.

In other words, if you had invested a $1,000,000 altogether in these companies at the start of the year, you would have made $230,631.76 in capital growth AND $26,592.26 in dividends, which is a total of $257,224.02 over the year as passive income!!

All the best,

Jack

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.