What a few days we have seen on the market!

To say that the selloff has been unexpected would be an understatement, especially at 2.30 yesterday afternoon when the news came through that the RBA had decided to cut interest rates to record lows and the much anticipated rate cut had occurred. Surely this was going to be the catalyst for a move through the holy grail XJO level of 6000.

What has subsequently happened in the following 8 hours of trading has been swift and would have seen a lot of investors pulling their hair out wondering how on earth things could turn so pair shaped in such a short space of time. The question to ask is “What has changed?”

The only thing can that be picked up on from the RBA minutes is that there was no clear easing bias in the coming months. What was also certain is that Glen Stevens will be wondering needs to be done to do to get the Aussie Dollar lower, interest rate cuts should push our dollar lower and be positive for the economy. The AUD/USD pair rallied directly after the cut.

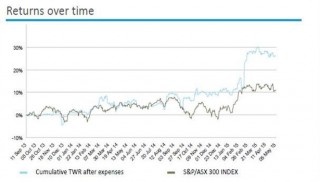

What does all of this mean for equity markets and more specifically what have we done to manage your risk. Firstly, the majority of the selloff has been in then high yielding stocks. In focus have been the banks who have reported this week, consistently we have seen margins coming under pressure and stagnating growth. Woolworths continues to disappoint and may look to break to new lows in the coming weeks. Below shows our exit from WBC – over $5 higher than the current share price. On a side note we are strongly recommending clients enter into our IPS strategies with share prices at these levels. Clients in the strategy are benefiting from the protected nature of these investments

WBC Chart

As most of our clients would know we have taken number of small losses over the last 3 weeks. While these can be difficult to take at the time they have proved effective in preserving capital. We have also managed to make a good profit on a hedge we opened up over the index.

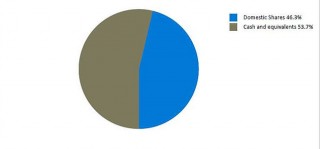

As of the end of April our asset allocation was sitting at 53.7% Cash and 46.3% in domestic shares. During the month of April we reduced our investments in shares by 20%

Current Weighting

At present we have a number of open position showing profitable position. By way of strength we continue to hold these position and believe that if we do rally these stocks will outperform compared to the rest of the market. We will provide more detail on this in our month in review early next week.

For more information, speak to our one of our Portfolio Managers on 1300 220 360