Market Wrap

August provided investors with a seriously bumpy experience – except the index hardly moved all month. It was reporting season and there were tears, cheers and fears.

Let’s start with the tears: APN Outdoor (APO) has been a market darling and it seemed that it was always trading on a new high. Investors liked what they saw and if you owned the stock you were in profit, and then it reported!! In what was the biggest fall from grace the stock fell over 25% and sent investors running and it hasn’t recovered. Unfortunately for APN Outdoor investors, the stock was not positioned to disappoint given its share price had surged in recent times. But the bigger blow came with its 2016 outlook: revenue growth of 6%-8% and EBITDA of A$79M-A$84M. That was down from previous revenue guidance of 8%-11% growth and EBITDA of A$84M-A$88M.

APO Daily chart

Source: Bloomberg

More tears for The Reject Shop (TRS) as it reported its full year numbers. Numbers were fine but the expansion of Aldi into South Australia and Western Australia saw a less than impressive outlook for the year. The stock fell 33% in 3 days after it was trading at all-time highs leading into the announcement.

And of course Blackmores (BKL). A company that is one of the market darlings (or was) saw its share price fall by over 10% in the first hour of trading after it reported. Is doubled it’s YOY growth but there was a little paragraph in the report suggesting that retailers had stockpiled their inventory levels towards the end of the financial year. Hence a slower start to sales and a dumping of the stock. To be honest the stock was trading irrationally and we have now exited this position. We took our medicine and moved on.

Other notable mentions go to QBE (down 10% after it reported) and BWX (also down 20% after the report)

The cheers were on JB Hifi (JBH) where we managed to take an exceptional profit for the portfolios. Locking this in was an easy decision as the stock had rallied close to 20% since our entry level.

More cheers were had for investors holding Woolworths where the stock rallied close to 10% after it reported a 1.23 billion dollar loss??? Amongst this loss was a business plan that is meant to lead them forward into the future – I’m not convinced and either is the market.

Other notable cheers for WEB, ALU and CCP

The fears were that no one wanted to hold heading into the report or that they had FOMO (fear of missing out). It was impossible to tell how a company report was going to be received by the wider market and we took our profits on FLT the day before it reported – this position resulted in a nice profit for our portfolio. On the day of reporting it was down 5% before closing up 5%. It was erratic and interesting viewing and not uncommon. Other notable intraday turnarounds were on SUL and BRG.

The market was confused.

August was a mixed month for risk assets with the credit the best of the major asset classes. China (3.9%), Japan (1.9%) and Europe (1.1%) saw gains on stocks, but the US (-0.1%) and Australia (-2.2%) went backwards. It is important to point out that the US is at all-time highs after the recent rally in a number of Nasdaq components and the Banks. Commodities mostly fell with the Bloomberg commodities index down 1.8% driven by falls in copper (-6.5%) and gold (-3.2%).

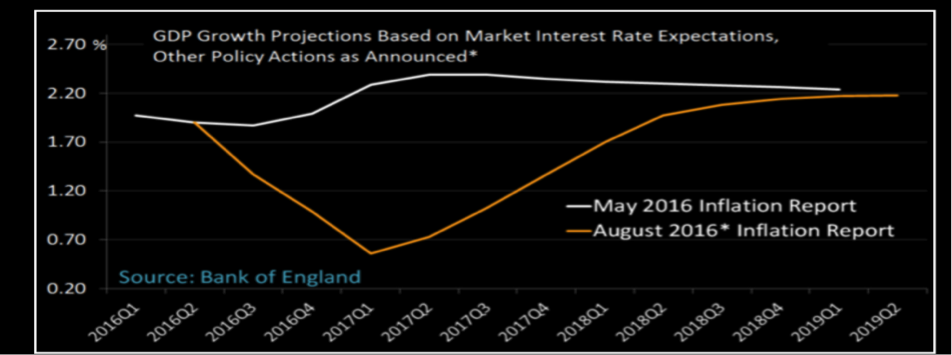

The Bank of England’s Monetary Policy Committee voted to introduce a big dose of stimulus at its August meeting. Strikingly, it did so despite seeing a significant overshoot of inflation at the end of the forecast period in the third quarter of 2019. Further incremental easing is possible, but the MPC may have already thrown the Hail Mary pass. That places a heavy focus on the government and Chancellor of the Exchequer Philip Hammond to take some of the strain with fiscal loosening in the fall.

Source: Bloomberg

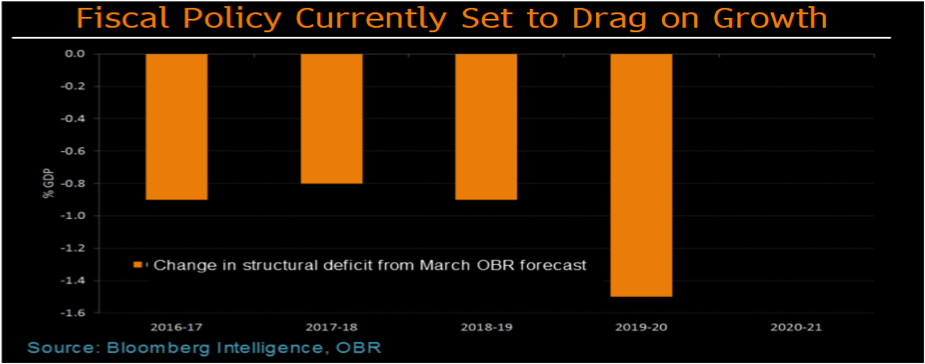

For a long time, Britain’s monetary and fiscal policies have been pulling in different directions. That could all change this autumn, if the government follows the Bank of England’s lead with some fiscal easing. However, those hoping for a full-blown fiscal stimulus plan may be left wanting. The impact of Brexit is likely to mean the U.K.’s fiscal watchdog hands the government a forecast showing a significant shortfall of revenues compared with expenditure, even before any changes to policy.

Source: Bloomberg

We remain cautious on equity markets at the moment with the US poised to set the tone over the coming months.

Growth Portfolio

The growth portfolio was erratic at best but still managed to make a profit for the month. We have maintained our US exposure through our Nasdaq Warrant (NDQ) – for the time being this is a hold.

JB Hi Fi saw us lock in a solid profit after its earnings announcement but we felt the brunt of Blackmores ”disappointing” report, losing around 12% on this position- despite being up over 10% heading into the report. If nothing else, the month of August kept us on our toes and tested our risk management protocol. I’m happy to say that all three of our exits were above current market levels.

Flight centre saw us take close to 20% as a profit after we exited before it reported. We chose to use the warrants for this investment to capitalise on the move higher.

We have identified a trading opportunity on Bank of Queensland and it has currently outperformed its sector peers. With a dividend yield close to 10% fully franked it should attract a wide array of investors at these levels

At present we only hold 2 positions in the growth portfolio. BOQ & NDQ. Our underweight holdings in the portfolio represents our cautious view on equity markets at the moment.

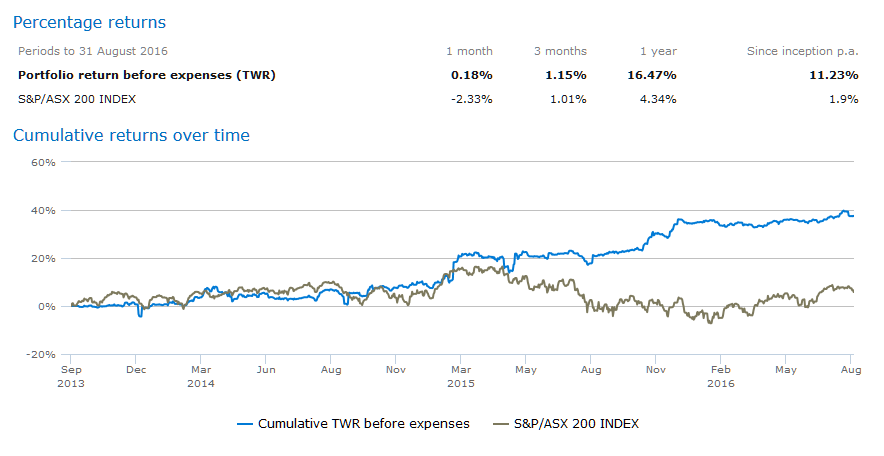

Unlike many traditional managed fund portfolios available, at VFS we continue to have a proactive approach to investing. When we are in a strong trend we have the ability to hold over the longer term and lock in larger profits for clients. We use technical analysis for our entry and exit providing us with a competitive advantage over many fund managers who rely solely on fundamental analysis and ignore market sentiment.

Year to date we have now outperformed by the XJO by 12% and for the last 3 years we have outperformed by over 30%.

Growth Portfolio Returns

Income Protected Portfolio

Throughout August we saw markets being overly complacent for the better part with selling only to be seen at the very start and at the very end of the month.

Complacency can be a worrying thing for markets as any slight increase in volatility can result in markets selling off aggressively in a very short period of time.

We enjoyed a good July period but heading into spring we feel we should err on the side of caution as September historically is one of the worst months for equity markets and we also have a number of other macro-economic events that could temporarily derail markets such as U.S presidential elections and U.S interest rates decision.

With volatility so low, protection for portfolios is cheap and we’ve been taking advantage of that by insuring and protecting our holdings by buying put options.

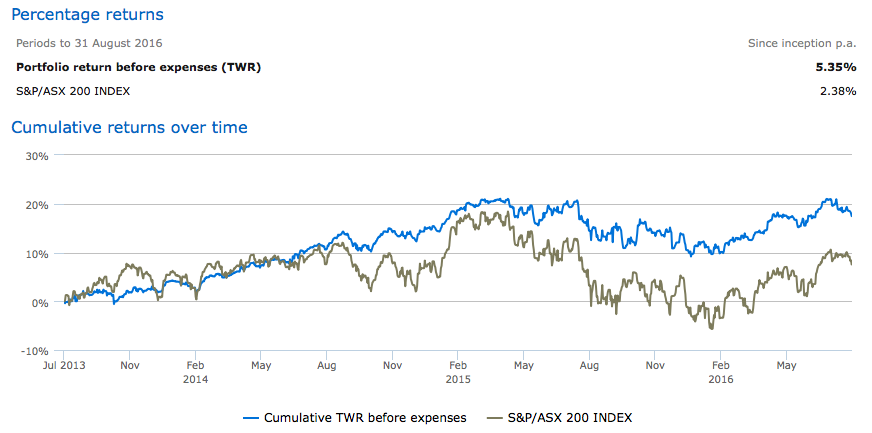

The Income Protected Strategy (IPS) is the heart and soul of our Income Protected Portfolio (IPP) which has been consistently outperforming the broader ASX200 for the past 3 years.

In July we exited Transurban Group (ASX:TCL) which are a toll roads owner and operator in Australia and in the U.S at a healthy 5.5% net profit for a 4 month trade with an exit of roughly $12.45.

In August we again added TCL to our IPP with a purchase price of $11.72 and protected the stock by buying January 2017 put options with a strike price of $11.50.

$11.50 is now our worst case scenario sale price as the put option serves as an insurance policy and protects our holding from $11.50.

We chose January for the put protection as the stock pays a dividend in late December and a big contributing factor to the success of this strategy is receiving a dividend.

The IPS generally consists of simultaneously buying stock, buying put protection and selling call options over the top to reduce costs.

Last time we entered into this strategy with TCL, we elected not to sell the call straight away and it paid off as we were able to raise the level of protection to above our entry price once the stock had pushed higher which effectively turned the position into a risk free trade.

We have done the same this time around as we’re of the view we will be able to achieve the same outcome over the coming weeks so for now the TCL position consists of owning shares and having put protection out to January at $11.50.

Our overall view of the markets remains fairly positive however we do still want to have adequate protection in case we do get a selloff in the coming weeks.

Income Protected Portfolio Returns

The Derivative Portfolio

August has been a quieter month for our derivatives trading as the XJO spent most of the month within a 150 point range.

It was characterised by moves that initially looked good, but failed to follow through. BHP was a good example of this with a nice break above $21 offering promising signs that we would see continued strength, only for the stock to falter trading sideways and finally drop lower over the last few days.

If an options position moves against us early, or fails to move as favourably as we expect, we will always look to exit near breakeven so that we can minimise losses. Further examples of this in August include

- Exiting WPL on its recent run up with a small loss (although we did have to wait a lot longer to exit WPL than intended).

- Wesfarmers butterfly which did not show much follow through, and as a result we exited this at a small profit.

The XJO has again proven to be a lucrative trading vehicle, with a nice profitable short trade that we set up mid-August coming to fruition this week.

We benefitted from the move higher in CBA early in August with nice profits from a call spread, however we have re-entered CBA call spreads after the stock went ex – dividend, and these positions are currently underwater. We do however have two months to expiry and CBA is currently holding above significant support levels.

We currently don’t have a lot of derivatives exposure, and we will remain patient in looking for favourable opportunities to enter in the coming weeks.

For more information on these portfolios or to speak to a Wealth Advisor, please call 1300 220 360.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.