The month of February saw our market continue its move progressively lower. We saw a new low reached when the market opened at 4710 – this level has not been seen since June of 2013 and we officially entered into a bear market on this day as we had declined by over 20% since the high in April last year.

During February we saw the first of what will be many attempts to get the oil price moving north. The idea was floated to co-ordinate a cut in output by major oil producing nations, this was a catalyst to get the oil price moving higher but it was extremely short lived as we continue to see Russia, the North Sea and West Africa continue to over supply the market. In theory it is more economical to float barrels at a cost of 0.85 bbl per month, yet in practice physical constraints make this more difficult.

It is quite interesting looking at the charts in energy stocks. They are low and extremely cheap at the moment, relative to where they were 18 months ago and against their historical valuations. If we compare this to the gold sector which is in the midst of a renaissance there are many similarities. Only 2 years ago many gold stocks were at all-time lows and were out of flavour for investors – the future was grim.

Below I have detailed some of the returns gold stocks have had over this period showing their lows compared to where they are now.

| Name | Code | Low | Price Today | Return |

| Santa Barbera Mining | SBM | 0.22 | $1.88 | 854.55% |

| Regis resources | RRL | $1.08 | $2.58 | 238.89% |

| Saracen Resources | SAR | 0.11 | 0.98 | 890.91% |

| Northern Star | NST | 0.67 | $3.90 | 582.09% |

| Newcrest Mining | NCM | $6.88 | $17.50 | 254.36% |

The point here is that we are in a cycle and cycles don’t last forever. Those with a medium-term view on the energy sector should be encouraged by the turnaround in the fortunes of these companies.

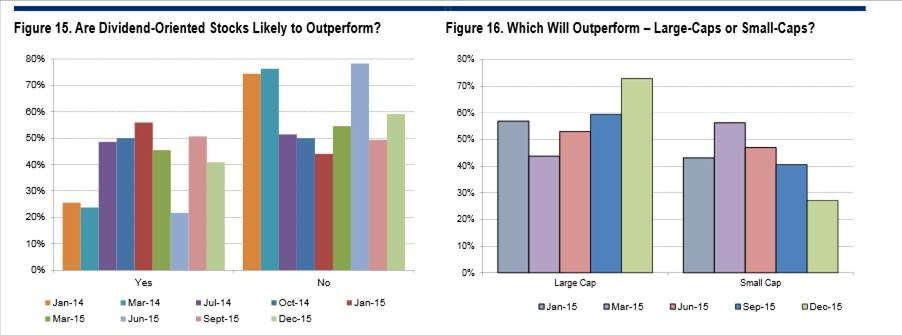

In February equity market headlines were dominated by the similarities with 2008 and this spooked many investors into fleeing the market. The simple equation running through Australian investors’ minds is that the housing market has to cool off which means that the banks are also going to fall. Our view is that the banks all reported in line with expectations which shows incredible resilience in the face on many other headwinds that they are already dealing with.

In the Australian market, it hasn’t been uncommon for the banks to follow the resource stocks over cycles, which is not that surprising given the size of both the resources sector and the banks in the economy. And if the latest developments in markets were to extend, with commodity prices falling significantly further again, it could create more risks for the banks and the outlook for the market. But so far in this resources downturn, the economy seems to be rebalancing well, and the credit cycle the banks often suffer seems less of a risk.

In this context, the sell-off in the Australian banks seems excessive to us at the moment. Perhaps more so, the severity of the fall in resource earnings now, and the supply curtailment occurring as a result, create potential for a steadying and improvement there as well.

By no means are we suggesting that there is no risk in the market. This risks are quite clear globally at the moment. The long-standing fragilities in the world economy relate to the structural and cyclical slowdowns in China and its unsustainable exchange rate regime, the excessive level of debt across many countries and sectors and ongoing regional and geopolitical uncertainty. In addition, there are now concerns about a cyclical slowdown in the advanced economies. This includes a large increase in the uncertainty about the outlook in the US, Euro Area, Japan and UK. Even though outright recession is unlikely in these countries, all are likely to show slower growth in 2016 than 2015.

Risks to the economic outlook are exacerbated by concerns that an appropriate countercyclical policy response would be lacking or that the policy response would be ineffective in a number of countries, including the US, the euro area, Japan, the UK and China.

Through all of this we are still seeing pockets of outperformance by certain sectors and industrials led the way during February. CIM, LLC and JHX all reported strongly pushing their share prices higher. Healthcare stocks also reported well with RHC, MPL and HSO all beating expectations.

Growth Portfolio

During the month of February we were relatively quiet. We continued to hold out A2M shares which released a solid half yearly, initially opening up over 25% before giving most of it back throughout the following week.

The share price is still above our recent entry but we are monitoring it extremely closely and are prepared to stop out. Other market darlings of 2015, Blackmores and Bellamys, have started the year negatively and we need to ensure we do not give back profits on this position.

We continue to hold SCG – Scentre Group and received a dividend of 10c during the month. The stock is still trending higher and our stop has now moved above our initial entry price. We also hold Metcash as our venture in to consumer staples.

We took a small loss on our short on Orica and in hind sight should have taken the profits off the table after it initially fell by 6% the day after entry.

Perfromance for the month was -1.24 which was slightly above the market a -2.49. Our portfolio since inception continues to outperform the XJO top 200

Defensive Portfolio

Volatility has been present in every way, shape and form in financial markets so far this year with big swings in equities, currencies and commodities.

Our IPS (Income Protected Strategy) has ensured all our clients have weathered the volatility storm far better than those who are just holding shares outright as the ‘protected’ element of the strategy ensures the downside risks are entirely managed.

Please watch the below video to see how this strategy could benefit your portfolio.

USA election

So it wouldn’t be a month and a review without covering the US elections and it’s been an amazing month at that in US politics. It has been an absolutely fascinating campaign particularly on the GOP side and also on the Democrat side.

Let’s start with the Democrats, In February this was a two horse race between the so-called democratic socialist Senator Bernie Sanders who by the way is actually not a member of the Democrats, and the and current Secretary of State representing at the Democratic Establishment candidate Hillary Clinton.

The month started with a stunning win by Bernie Sanders in New Hampshire primary election on February 10, 2016 and all of a sudden it seemed to be inevitable that Hillary would ease to victory.

The democratic party was looking at Benny Sanders as an alternative to become the Democratic nominee for the US 2017 presidential election however at the close of the month as this is released it is clear now that Hilary Clinton will be the democratic nominee for the most powerful office in the world. However, she has not come up unscathed from this, she has had to move her rhetoric further to the left than she would of wanted in order to stave Sanders almost revolutionary cause, and this may hurt her in 2017 when it comes to attracting the centrist vote.

Hilary has also shown she is not a great a campaigner, and can be ruffled by the right person. Maybe someone who is aggressive, outlandish and a billionaire? However, lock Hilary in, and for Wall St she is a good candidate.

Now to the fun stuff. This has been the most amazing riveting republican nomination in US history. Going into February the field was open, we had Jeb Bush, Marco Rubio, Ted Cruz, and John Kasich. Did we forget anyone? Oh that’s right some guy called Donald Trump. Ok enough joking, as we sit today the most realistic outcome is that Donald Trump a former New York Democrat will be the Republican Nominee. As we speak it is a 3 horse race, Trump in the lead, followed by Senator Cruz and Marco Rubio. We are calling Trump to win, unless either Cruz or Rubio pull-out and get behind the other. That is the only way Trump can lose at this stage.

Conservative America faces a dilemma while Trump’s directness and disregard for political correctness does resonate with conservatives, he doesn’t have a history of staying on agenda. Everything he says now could change when he gets in the White House, and if he does get in there and acts as poorly as some people think he will, send the American Conservative movement back 25 years.

One last thing, don’t think Trump can’t beat Hilary, he can. He has shown that he is a threat and can appeal to the masses.

We can’t wait to see how this plays out.

For more information please don’t hesitate to contact our investment team on 1300 220 360.

VFS Group