Sometimes the Australian market has an ability to fall despite what the rest of the world is doing. We have been on the end of some serious selling since the start of May – our market was down over 9% at one point. During the same period of time the FTSE was down 4% and the Dow Jones was down 3%.

Australia’s trade surplus rose by 24% in the quarter, driven by a 5.8% increase in exports, thanks to a 6.9% fall in the Aussie dollar over the period, outpacing a 4.0% increase in imports. In the midst of the fall in our market we saw some impressive GDP figures for the quarter, this did little to alleviate any speculation of a rate cut and hence we saw more selling. In fact most of the data was positive over the past month with the exception of building approvals which fell 4.4%

So what was the reason for this sell off? The answer lies in the ongoing rise in bond rates in Germany which is translating to bond rate rises in the US and across the globe. Higher global bond rates make Australia’s yield stocks less attractive, so it’s not just domestic sellers in there trashing our market. It was quite evident that the international sellers were taking hold of our relatively small market.

I’m not even going to mention Greece except for the fact that the can has been kicked down the road again. The reality is this is a bit of a rolling side show for the time being.

Our Growth portfolio saw only one new position entered into which was a short dated trade on Amcor. After picking up the warrant for $2.80 we exited the position only 5 days later for $3.30. We were stopped out of 2 of our holdings, CGF and VED.

We also rotated our health care stocks moving out of our position in HSO and adding a position in JHC.

![]()

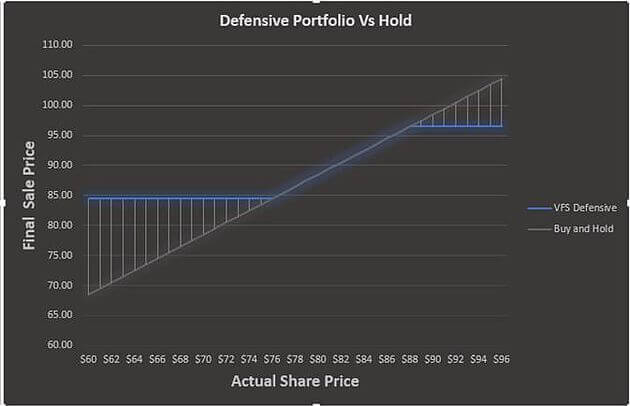

Defensive Portfolio

The investment mandate of the VFS defensive portfolio is to outperform when the markets are moving lower by protecting the asset but to also to provide long term returns to the investors through conservative growth and income. This is exactly what the VFS Defensive Portfolio has done during the recent sell-off in equity markets.

Ground-break research from Proteomics International (PIQ)

A standout of performer for some our clients is Proteomics International (PIQ). This was an IPO offered to our clients in March.

This stock has rallied over 200% since its listing. We met with PIQ’s director, Richard Lipscombe, yesterday to gain an insight into the new developments and we were extremely pleased with the direction of the company.

The company has been heavily supported after the results of their ground-breaking Predictive Test for Diagnosis of Diabetic Kidney Disease. The test, called PromarkerD, is the world’s first proteomics-derived predictive test for the condition.

Study Results

The results show PromarkerD can predict:

- Which patients with diabetes will progress to have a significant decline in kidney function better than any other current known measure; and

- Which people with apparently healthy kidney function as measured by conventional tests are at risk of kidney problems.

Specifically, the clinical study, which is on-going, found that 10% of the patients had a significant and rapid decline in kidney function over the four year study period and that PromarkerD correctly predicted 67% of these individuals.

Commercial potential

The International Diabetes Foundation estimates that 382 million people currently have diabetes worldwide and the number is expected to rise to 1 in 10 of the world’s population by 2035. According to the US Centre for Disease Control, 35% of adults with diabetes have chronic kidney disease and 20% will end up with kidney failure, which can only be treated by dialysis or a kidney transplant.

Extending PIQ’s clinical study findings to the larger worldwide problem suggests that 25 million individuals of the 38 million at risk of significant and rapid decline in kidney function could be identified by PromarkerD. This would represent a massive potential market for the technology owner/developer and any licensing partner(s).

Your Team,

VFS Group