Afternoon all,

Firstly some apologies. According to clients and colleagues I’ve been a little negative lately and some have pointed to the theme of my notes lately as evidence.

All I’ve done is point out the significant headwinds we’re facing and allowing people to make appropriate diversification preparations. I’ll try and stop going on about the banks and point to the real reason for the negativity being that I now sit next to the office television which plays a continual stream of advertisements ranging from health insurance, life insurance, funeral insurance, pet insurance and disability insurance. There’s only so many reminders of your own fragile mortality you can take in a day before you start to get a little caught up in it. (However I’ve picked up a screaming deal on pet insurance!!)

I’m now aware of the problem and I promise to put the rose-coloured glasses back on and keep buying. A good motto for this newfound enthusiasm was coined by Chris Weston over at IG Markets after the Chinese GDP data came in (unsurprisingly) strong

“China is solved- GET INVOLVED”

Sounds like a plan. There are always places to invest no matter what the weather. I caught this article from Chris Pash at Business Insider noting something scary though:

Spoiler: Bad debts in Qld & WA have increased personal insolvencies for four straight quarters. That last happened in 2009 and that period in our history isn’t one you want to be matched with. Look for further increases in mortgage delinquencies and personal insolvencies in mining states as this continues. Commodities may be ‘uppish’ at the moment but it will take more than 6.7% Chinese GDP growth to bring those little mining towns back to their former glory. People are losing jobs now and they have mortgage repayments now and the three investment properties they bought in Perth are empty now and you have payments on them now. You’re running right out of options. China isn’t going to be better in time for this guy’s problems to be solved.

One of the hardest things a stockbroker has to do is separate yourself from the emotions this news brings but you can’t avoid it. (You shouldn’t enjoy it. You shouldn’t avoid it either)

I’m looking at some great little companies in the debt collection and debt consolidation space that look like screaming buys in an environment like this and I’m happy to discuss options on these.

Running with this theme, the RBA’s Financial Stability Review has warned of a glut in apartments is a threat to, well, pretty much everything. Clearance rates are down, transaction numbers are down and property prices are going backwards. My favourite commentator wrote an excellent piece on it over the weekend so anything else I write here will look like I’m just ripping him off but you can find it here. Thanks, JP. It’s exactly what I was going to write about but you’ve said it much better than I ever could.

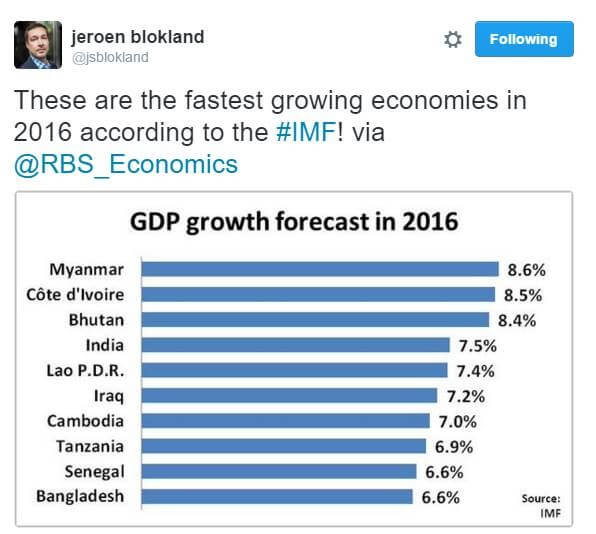

Moving on to global matters before we get to oil. There’s this which I’ll just leave up here and you can go ahead and formulate your own investment ideas:

Only one of the BRICs making a 4th place cameo. Interesting…

Oil has had a stunning week and acted predictably leading into Doha. If you’d made so much in a week being long oil would you really want to be holding the whole position going into a meeting of the oil cartel? Probably not. I’ve never felt like a spectator at a fantastic game of chess more than lately in watching the oil markets. Iran is making all the difference by opting out of any production freeze agreement and increasing shipments by more than 600k barrels a day in April. They’ve been on a world-imposed export restriction for years which they’ve now escaped. You think they’d be keen to go ahead and give themselves a speeding ticket now?

The Saudis have a real hang up about Iran (as they just proved) and the ‘No Deal in Doha’ has caused obvious disarray in oil markets. Stay close to the headlines on this one.

See? I did all that without talking about the banks? (Which the market is now pricing cuts to dividends as a near-certainty).

Ok, one mention. That’s still pretty good.

Stay safe out there and all the best,

James

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.