First off please take a minute to peruse this from the FT outlining the politics behind the 19th National Congress of the Communist party of China kicking off tomorrow.

Click here to view the FT’s take on what to look for

I had to pass up my invite to Beijing this time but will be watching with interest. I’m fascinated by how much of it remains shrouded in mystery, such as the number of seats on the all powerful Politburo Standing Committee. It’s fascinating to me and I’m a person who finds it difficult to be fascinated by anything.

China (and therefore the rest of the world) goes into a little bit of a spell during the Congress as we wait for news, the key thing to keep an eye out for is that whatever policy China had going into it could change next week once everyone has their job sorted for the next five years. Note also Chinese GDP is out on Thursday so all eyes on steel, iron ore & coal.

In other news…

Would you have a look at this market!

A glorious exuberance has infected local trade in a way not seen in months. The fuzz we’ve been in since mid-May has ended and the ASX 200 looks set to move on to 6000. Randomly drawn lines on charts have been blown away. At the top of this article is a great comment by the man who brought down Barings Bank, Nick Leeson, remarking on the Japanese Market as it reached similar long-term highs.

“A glorious exuberance” Courtesy Iress

There’s been activity in the metals space and I’ll take the simplest indication that the world is booming in the copper price. I won’t use the usual platitudes on “Dr Copper” (too late!) but I will make it known that I’m firmly of the belief that if copper is rallying then the world is OK.

Copper price over two years breaking to new highs… Courtesy Bloomberg

Copper means growth and growth means rates up. Prepare yourself accordingly..

Our dear friend Lithium is also going gangbusters and my favourite stock that isn’t Amazon, Albemarle (world’s biggest lithium producer) continues to break new ground. I still like this stock, listed in the US and it’s a great example of what we can do when it comes to investing globally. It’s a real struggle to find a large cap producer of lithium here in Australia so we went offshore and found the biggest.

Why not?

Albemarle daily chart continuing Courtesy Bloomberg

Finally, as all would be aware my dislike for hack ‘Internet of Things’ companies is well known. I’ve done notes on it in the past and will continue to do them in the future. This one’s my favourite because it contains “Smart Underpants”

The Internet of Nonsense

This dislike goes beyond the tech scams and into disruptors overstepping the mark and trying to push tremendously bad ideas as “hip new innovations for the avocado-crowd”.

Two exhibits from Silicon Valley:

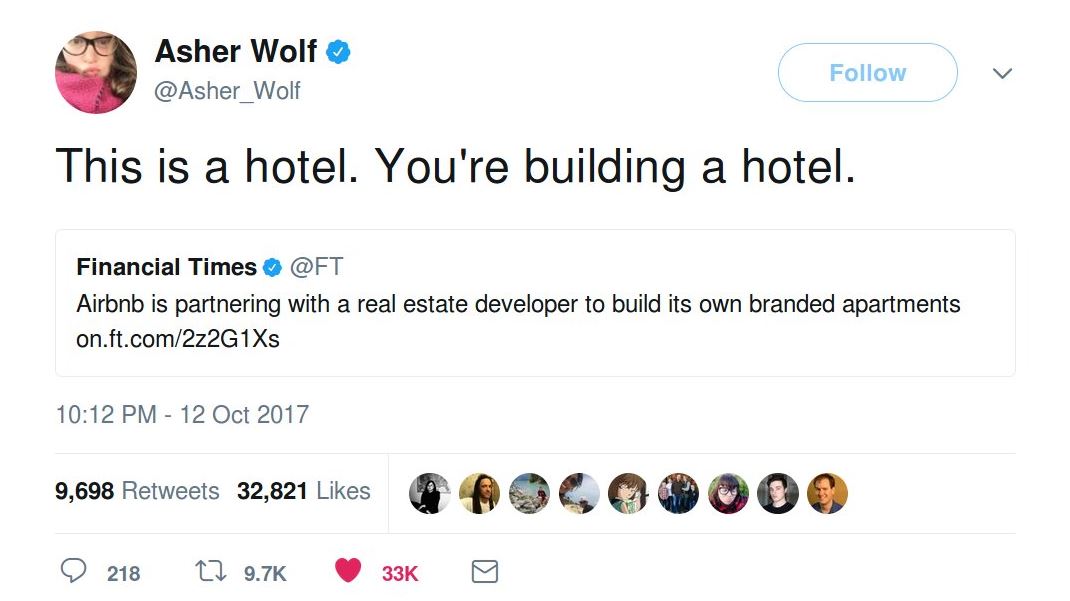

Firstly hotel-disruptor Airbnb recently released details covered by the Financial Times that it was to team up with a developer to launch “branded apartments”.

The idea was given the response it deserved by Twitter’s @Asher_Wolf.

Classic…

No punches were pulled…

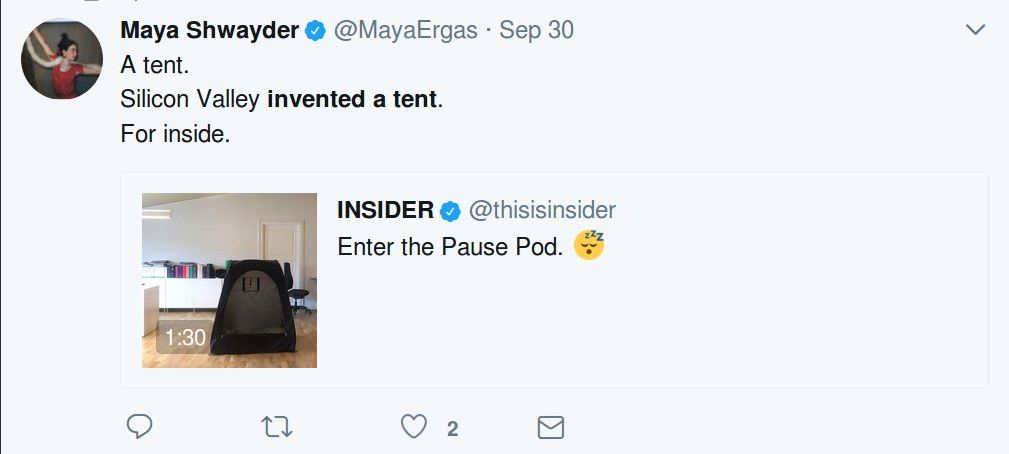

Secondly was something that even I had to watch a few times. It’s called the Pause Pod and from what I can see it’s not a joke. Link is here and if you were looking to eliminate your last hope for humanity I suggest you have a look.

It was also given the short service by the good people of Twitter.

Anyone else notice that the only people using the Pause Pod are men? We’re a strange species…

Don’t forget about our short webinar on Thursday night. Just a quick overview of what’s going on. Register here.

Stay safe & all the best,

James Whelan & the VFS Global Macro Fund

Level 30 Australia Square, 264 George Street, Sydney NSW 2000

t +1300 220 360 | m +61 407 958 036 | www.vfsgroup.com.au/gmf

Additional: Our own Head of Financial Advisory Danilo Medojevic has been shortlisted for the finals of the SMSF Adviser Summit Awards in the field of SMSF Investment Strategy. We wish him all the best to get the gong.

Disclaimer:

This Communication has been prepared by Vertical Capital Markets Pty Ltd (ABN 11 147 186 114 AFS Licence No. 418418) trading as VFS Group (VFS Group).

This Communication is for general information purposes only. It does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of the information contained in this report, you should consider whether the information is appropriate in light of your particular investment objectives, financial situation or particular needs. You may wish to consult an appropriately qualified professional to advise you. Derivatives can be highly leveraged, carry a high level of risk and are not suitable for all investors. Investors should only invest in such products if they have experience in derivatives and understand the associated risks.

VFS Group and/or entities and persons connected with it may have an interest in the securities the subject of the recommendations set out in this report. In addition, VFS Group and/or its agents will receive brokerage on any transaction involving the relevant securities or derivatives.

If you receive this Communication in error, please immediately delete it and all copies of it from your system, destroy any hard copies of it and notify the sender. If you are not the intended recipient, you must not disclose the information contained in this Communication in any way.