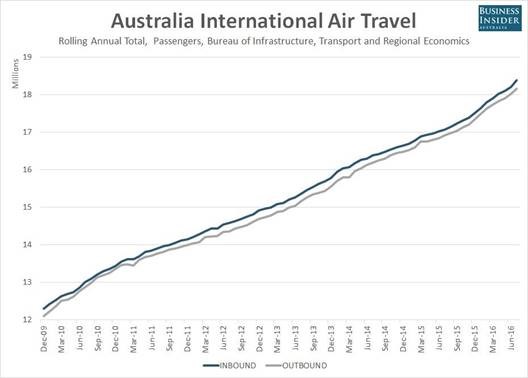

If you haven’t already, please check out our latest contribution to Business Insider’s ‘Devils & Details,’ the most popular business podcast in Australia. We cover OPEC, the RBA & the ongoing commodities rally. At the end I also tip the Swans and the Storm so I’m due a few wins this week I’d say.

There’s been plenty going on this week that’s caught my attention. Unfortunately just the facts today for some obvious reasons.

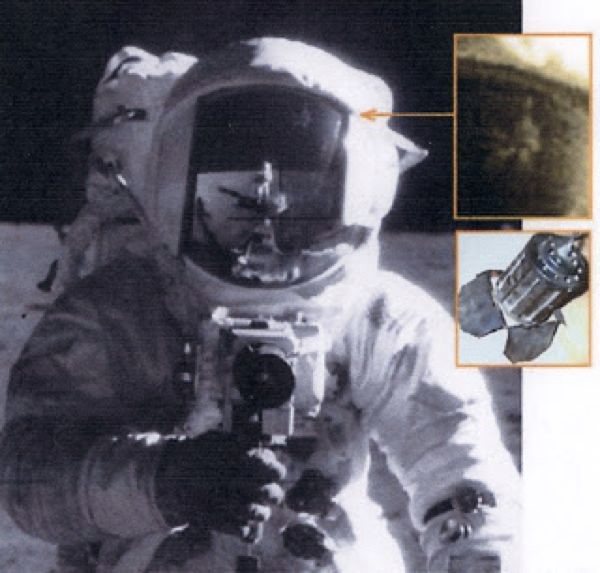

Firstly, and I think most importantly, this appeared on my timeline over the long weekend…